Unfortunately for some shareholders, the Skillsoft Corp. (NYSE:SKIL) share price has dived 35% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 80% share price decline.

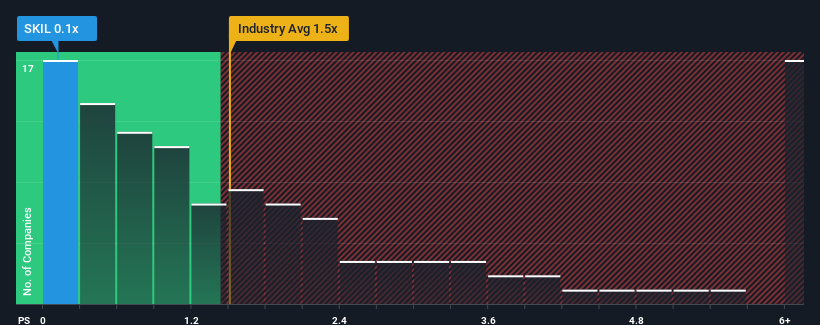

After such a large drop in price, Skillsoft may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Professional Services industry in the United States have P/S ratios greater than 1.5x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Has Skillsoft Performed Recently?

While the industry has experienced revenue growth lately, Skillsoft's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Skillsoft will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Skillsoft?

In order to justify its P/S ratio, Skillsoft would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Skillsoft would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 24%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 3.1% during the coming year according to the three analysts following the company. That's shaping up to be materially lower than the 6.5% growth forecast for the broader industry.

With this in consideration, its clear as to why Skillsoft's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Skillsoft's P/S?

Skillsoft's recently weak share price has pulled its P/S back below other Professional Services companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Skillsoft's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you settle on your opinion, we've discovered 2 warning signs for Skillsoft that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.