Shanghai Ailu Package Co., Ltd. (SZSE:301062) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Notwithstanding the latest gain, the annual share price return of 2.1% isn't as impressive.

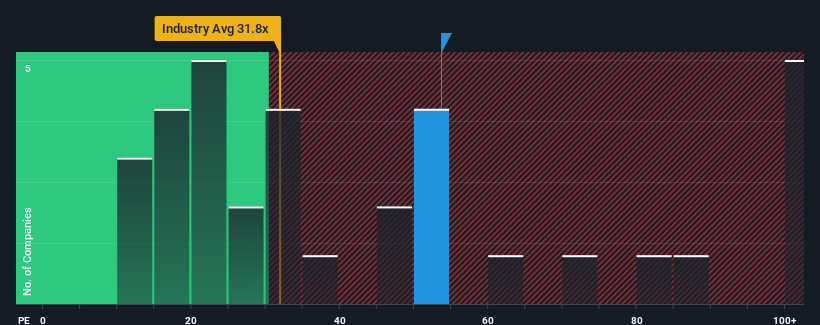

After such a large jump in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 31x, you may consider Shanghai Ailu Package as a stock to avoid entirely with its 53.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Shanghai Ailu Package could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Does Growth Match The High P/E?

Shanghai Ailu Package's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Shanghai Ailu Package's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 33% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 30% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 58% during the coming year according to the one analyst following the company. With the market only predicted to deliver 40%, the company is positioned for a stronger earnings result.

With this information, we can see why Shanghai Ailu Package is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Shares in Shanghai Ailu Package have built up some good momentum lately, which has really inflated its P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Shanghai Ailu Package maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Shanghai Ailu Package that you should be aware of.

Of course, you might also be able to find a better stock than Shanghai Ailu Package. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.