Shenzhen Prince New Materials Co.,Ltd. (SZSE:002735) shareholders are no doubt pleased to see that the share price has bounced 50% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 29% over that time.

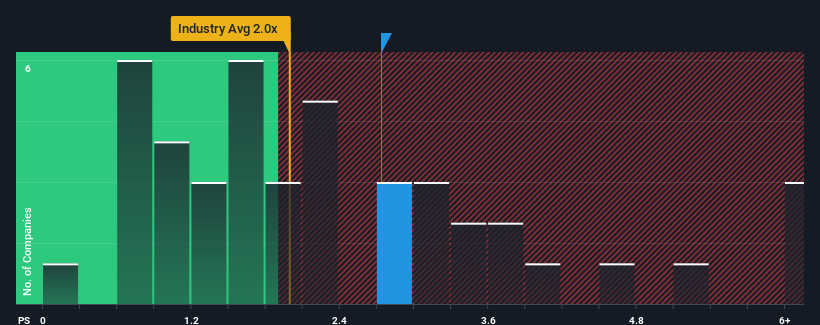

Since its price has surged higher, when almost half of the companies in China's Packaging industry have price-to-sales ratios (or "P/S") below 2x, you may consider Shenzhen Prince New MaterialsLtd as a stock probably not worth researching with its 2.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does Shenzhen Prince New MaterialsLtd's P/S Mean For Shareholders?

There hasn't been much to differentiate Shenzhen Prince New MaterialsLtd's and the industry's retreating revenue lately. One possibility is that the P/S ratio is high because investors think the company can turn things around and break free from the broader downward trend in revenue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Shenzhen Prince New MaterialsLtd will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Shenzhen Prince New MaterialsLtd?

Shenzhen Prince New MaterialsLtd's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Shenzhen Prince New MaterialsLtd's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.5%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 17% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 36% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 20%, which is noticeably less attractive.

In light of this, it's understandable that Shenzhen Prince New MaterialsLtd's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Shenzhen Prince New MaterialsLtd's P/S?

The large bounce in Shenzhen Prince New MaterialsLtd's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Shenzhen Prince New MaterialsLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Shenzhen Prince New MaterialsLtd (of which 1 is significant!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.