Those holding Hydsoft Technology Co.,Ltd. (SZSE:301316) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 24% in the last twelve months.

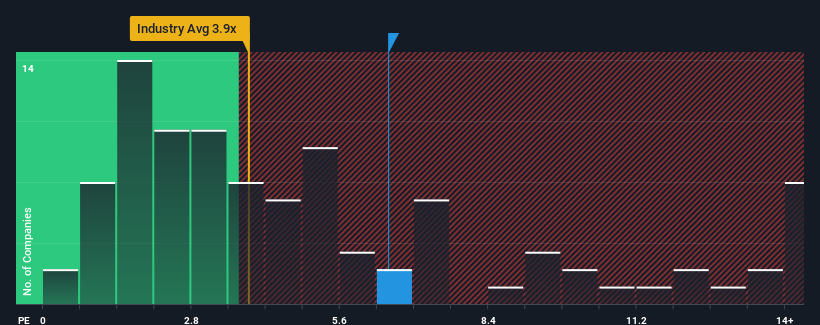

Since its price has surged higher, when almost half of the companies in China's IT industry have price-to-sales ratios (or "P/S") below 3.9x, you may consider Hydsoft TechnologyLtd as a stock not worth researching with its 6.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Has Hydsoft TechnologyLtd Performed Recently?

Revenue has risen firmly for Hydsoft TechnologyLtd recently, which is pleasing to see. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Hydsoft TechnologyLtd's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Hydsoft TechnologyLtd?

In order to justify its P/S ratio, Hydsoft TechnologyLtd would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Hydsoft TechnologyLtd would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 15% gain to the company's revenues. The latest three year period has also seen an excellent 98% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 41% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that Hydsoft TechnologyLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Hydsoft TechnologyLtd's P/S Mean For Investors?

Hydsoft TechnologyLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Hydsoft TechnologyLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Hydsoft TechnologyLtd with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.