The top three net purchases on the Dragon Tiger list are Anoch, Wall Nuclear Materials, and Reader Culture

Today, the market index closed down slightly. More than 2,900 shares fell in the two markets, 2,200 stocks rose, 79 stocks rose or stopped, and 9 stocks fell to a halt.

Kimi is popular, and the hot spots in the market are still AI-related. The media, education and other application sectors performed best, and pork stocks, the low-altitude economy, and nuclear power were active.

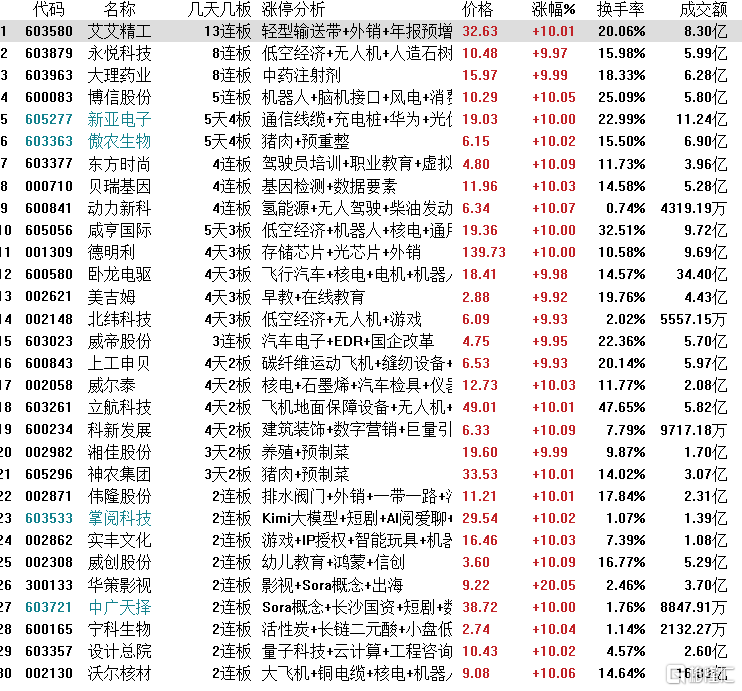

In terms of high-ranking stocks, the machinery and equipment sector is Ai Seiko's 13 connected board; the low-altitude economy concept unit is Aviation Technology's 13-day 9 board, Yongyue Technology's 8-connected board, Oriental Fashion 4-board, Kimi Concept, Huace Film and Television, and Zhongguang Tianze 2 connected board, pharmaceutical stock Dali Pharmaceutical 8 connected board, Berry Gene 4 connected board, Robot Boxin Co., Ltd. 5 connected board, and pork stock is Aonong Biotech's 5-day 4 board.

Let's take a look at today's Dragon Tiger rankings:

Today, the top three net purchases on the Dragon Tiger list are Anoch, Wall Nuclear Materials, and Reader Culture, which are 111 million yuan, 458.997 million yuan, and 395.264 million yuan respectively.

The top three net sales figures on the Dragon Tiger list were Furong Technology, Longway Co., Ltd., and Annell, which were 120 million yuan, 8,671.8 yuan, and 854.991 million yuan respectively.

Among the individual stocks involved in dedicated institutional seats in the Dragon Tiger list, the top three were Annuoqi, Wall Nuclear Materials, and Zhongrun Resources on the same day, which were 21.4533 million yuan, 127.784 million yuan, and 11.5542 million yuan respectively.

Among the individual stocks involved in exclusive institutional seats in the Dragon Tiger list, the top three were Huace Film and Television, Seagull shares, and Demingli, which were 54.632 million yuan, 36.2575 million yuan, and 29.2428 million yuan respectively.

The subject of some of the individual stocks on the list:

Anoch (cross-border layout computing power+proposed acquisition of Shanghai Hengcong+Sora concept)

First board, with a turnover of 1,219 billion yuan and a turnover rate of 31.13%.

Tu Wenbin made a net purchase of 34.17 million yuan, a net purchase of 21.45 million yuan from a single agency, and a net purchase of 22.01 million yuan from low-level mining.

1. Anoch plans to acquire Shanghai Gencong at a purchase price of no more than RMB 100 million. Shanghai Gencong is a high-tech enterprise focusing on computing power acceleration services and computing power management. It is a member of Nvidia's Startup Acceleration Program, which aims to cultivate outstanding AI startups that disrupt the industry landscape.

2. Yizhan AI, a subsidiary of Shanghai Gencong, provides a social platform for AI painting, AI photography, and AI animated (video) content creation.

Wall nuclear materials (large aircraft+nuclear power+robot)

2 consecutive boards, with a turnover of 1,603 billion yuan and a turnover rate of 14.64%.

Shenzhen Stock Connect had a net sale of 12.59 million yuan, Shanghai's ultra-short net sale of 34.36 million yuan, and the two institutions had a net sale of 88.19 million yuan.

1. Wire products mainly include high-speed communication lines, automotive industrial lines, industrial robot cables and other series of products. Industrial robot lines can be widely used in the field of industrial robots. Currently, they are used in six-axis industrial robots (8KG-150KG level), SCARA robots, collaborative robots, etc.

2. In 2023, we achieved operating income of 5.748 billion yuan, an increase of 7.63% year on year; net profit to mother was 709 million yuan, an increase of 15.4% year on year.

Furong Technology (AI phone+state-owned enterprise reform)

After 3 consecutive shares, the stock price plummeted 7% today, with a turnover of 1,547 billion yuan and a turnover rate of 11.23%.

Hujialou had net sales of 114 million yuan, Beijing's Zhongguancun net sales of 45.69 million yuan, and Northeast Men's net sales of 24.89 million yuan.

1. The company announced that its main business is R&D, production and sales of aluminum structural materials for consumer electronics products. The main products are aluminum structural materials for consumer electronics products, which are further processed and used in smartphones, tablets, laptops, etc. The company's products do not have AI features.

Institutions focus on trading individual stocks:

Huace Film and Television:2 consecutive boards, with a turnover of 370 million yuan and a turnover rate of 2.46%. The net sales of the three institutions were 54.63 million yuan, and the quantitative fund had net sales of 13.1 million yuan.

Seagull shares:It fell 8.56%, with a turnover of 327 million yuan and a turnover rate of 13.43%. Wenzhou made a net purchase of 4.02 million yuan, and the agency made a net sale of 39.69 million yuan.

Demingley:3 boards in 4 days, with a turnover of 969 million yuan and a turnover rate of 10.58%. Owner Zhang Meng made net purchases of 20.41 million yuan, net institutional sales of 29.24 million yuan, Sunan Bang net sales of 17.82 million yuan, and Shenzhen Stock Connect's net sale of 34.06 million yuan.

ANNEL:Tianfu, with a turnover of 1,337 billion yuan and a turnover rate of 37.38%. Ningbo Sangtian Road made a net purchase of 18.89 million yuan, and Sunan Bang sold a net sale of 10.14 million yuan.

Zhongrun Resources:First board, with a turnover of 697 million yuan and a turnover rate of 18.11%. The net purchase of Qujiang Pool was 15.52 million yuan, and the net purchase of the institution was 1.05 million yuan.

In the Dragon Tiger list, there are 4 individual stocks involving exclusive seats on Shanghai Stock Connect. The net purchase was 5.44 million yuan for City Media, 1.71 million yuan for Oriental Fashion, and a net sale of 13.39 million yuan for Guoli shares and 2.29 million yuan for new power materials.

In the Dragon Tiger list, there are 7 individual stocks involving exclusive seats on Shenzhen Stock Connect. The net purchase was 33.44 million yuan for Mingpu Optoelectronics and 6.07 million yuan for Xiaxia Precision, and net sales of 34.06 million yuan for Demingli, 1998 million yuan for Zhongke Jincai, 19.07 million yuan for Yidao Information, and 12.59 million yuan for Wall Nuclear Materials.

Trends in volatile capital operations:

Low-level excavation:Net purchases of Annuoqi RMB 22.02 million, Xinchen Technology RMB 2014 million, and Siquan New Materials RMB 5.53 million

Ningbo Sangtian Road:Net purchases of Annel RMB 18.89 million, Urban Media RMB 9.09 million, net sales of Changqing Technology RMB 8.3 million, and Yidao Information RMB 19.05 million

Fang Xinxia:Net purchase of Mingpu OptoMagnetics RMB 39.15 million

Writer Shinichi:Net sales of Honda's new materials amounted to 13.62 million yuan

Tohoku Takeo: Net purchase of Oriental Fashion for 8.98 million yuan, Anbang Guard for 4.6 million yuan, net sale of Furong Technology for 24.89 million yuan, Longqi Technology for 19.14 million yuan, and Rice Information for 11.8 million yuan

Ma Xinqi of the Ningbo Daredevil Team:Net sale of Longway shares of $15.72 million

Leader of the Chapter League:Net purchase of Demingli for 20.41 million yuan, net sale of Chaoxun Communications for 42.08 million yuan

Little crocodile:Net sale of Evergreen Technology for 7.57 million yuan