It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Shanghai Runda Medical Technology (SHSE:603108). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Shanghai Runda Medical Technology's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Over the last three years, Shanghai Runda Medical Technology has grown EPS by 15% per year. That's a pretty good rate, if the company can sustain it.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Shanghai Runda Medical Technology reported flat revenue and EBIT margins over the last year. While this doesn't ring alarm bells, it may not meet the expectations of growth-minded investors.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Shanghai Runda Medical Technology reported flat revenue and EBIT margins over the last year. While this doesn't ring alarm bells, it may not meet the expectations of growth-minded investors.

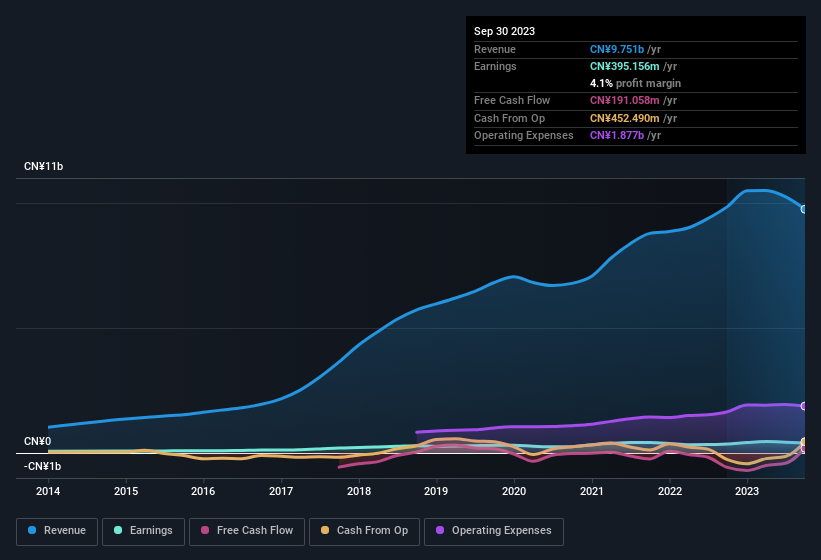

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Shanghai Runda Medical Technology's balance sheet strength, before getting too excited.

Are Shanghai Runda Medical Technology Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Shanghai Runda Medical Technology followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. Indeed, they have a considerable amount of wealth invested in it, currently valued at CN¥2.5b. Coming in at 18% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Looking very optimistic for investors.

Is Shanghai Runda Medical Technology Worth Keeping An Eye On?

One important encouraging feature of Shanghai Runda Medical Technology is that it is growing profits. To add an extra spark to the fire, significant insider ownership in the company is another highlight. The combination definitely favoured by investors so consider keeping the company on a watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Shanghai Runda Medical Technology (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.