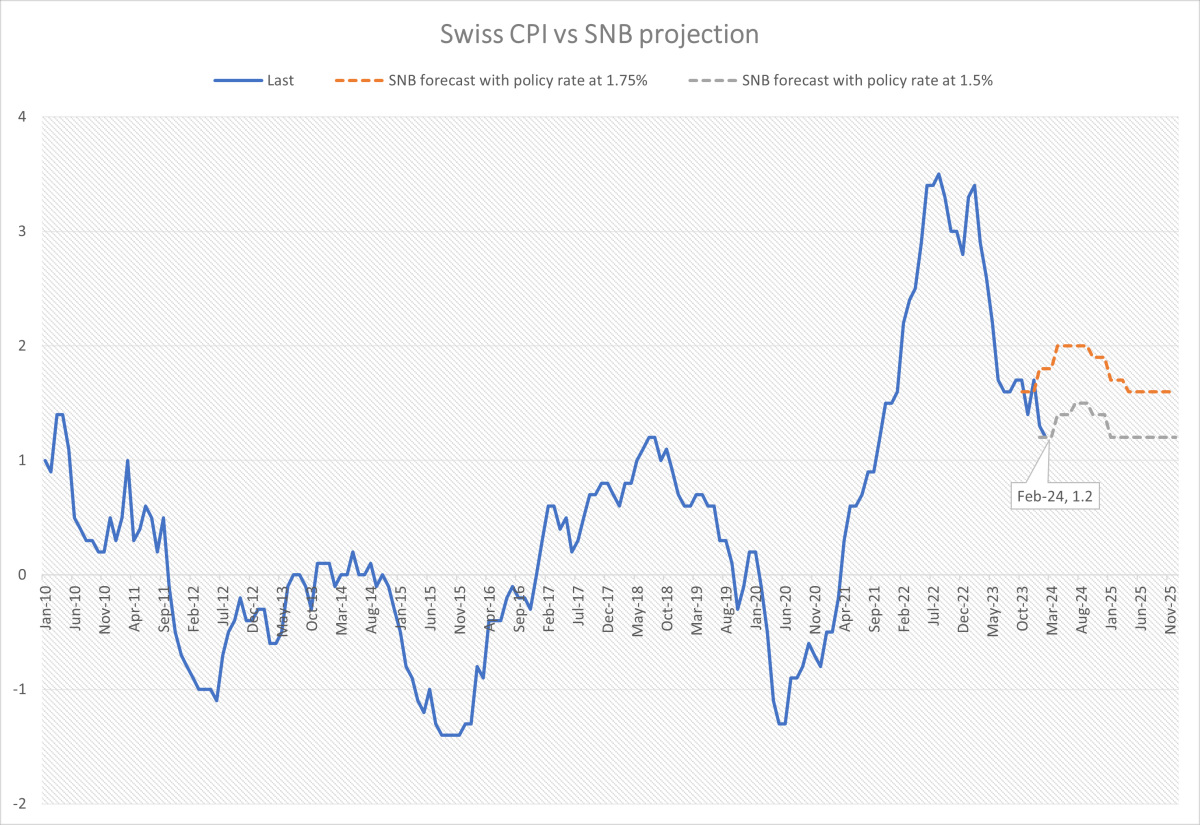

The SNB unexpectedly cut interest rates, kicking off a global easing cycle. Despite expectations, the central bank decided to lower the benchmark interest rate by 25 basis points to 1.5%. This move is seen as a response to low consumer price index data, showing that cutting interest rates is a reasonable choice.

(Figure: Swiss CPI and SNB estimates)

Monex foreign exchange trader Helen Given said, “The SNB's actions have increased pressure on other G10 central banks to cut interest rates faster than expected, but given that Federal Reserve Chairman Powell just spoke yesterday about the decision to keep interest rates unchanged, other currencies are falling while the US dollar remains strong. Powell's remarks seemed more hawkish than the market initially understood, so the dollar benefited.”

Monex foreign exchange trader Helen Given said, “The SNB's actions have increased pressure on other G10 central banks to cut interest rates faster than expected, but given that Federal Reserve Chairman Powell just spoke yesterday about the decision to keep interest rates unchanged, other currencies are falling while the US dollar remains strong. Powell's remarks seemed more hawkish than the market initially understood, so the dollar benefited.”

Emerging financing currency: the Swiss franc

As the Swiss central bank prepares for further interest rate cuts in the future, traders may see the Swiss franc as a new funding currency. Meanwhile, the Bank of Japan also announced interest rate hikes, which exacerbated changes in the market.

On Friday (March 22), the US dollar fluctuated in a narrow range against the Swiss franc in the Asian market. Currently, trading is around 0.8972. The exchange rate surged 1.21% on Thursday, hitting an intraday high of 0.8993, a new high since November 14, and closed at 0.8974.

The Bank of England is dovish

The Bank of England continues to maintain a dovish stance, and even if two hawkish members change their positions, they vote for keeping interest rates unchanged. The central bank stressed that even if interest rates are cut, the policy will remain restrictive, which makes the market more inclined to cut interest rates early in June rather than August.

The Federal Reserve hinted at cutting interest rates in June

The Federal Reserve is likely to cut interest rates in June and is expected to cut interest rates three times in 2024. Although the distribution of the bitmap is more hawkish, Chairman Powell continues to maintain a dovish stance in an attempt to tone down his disappointment with the inflation report.

Win Thin, head of global market strategy at Brown Brothers Harriman, said, “I think the market's dovish view of the Federal Reserve is wrong, so I think there is room for the dollar to rise further.”

Monex外汇交易员Helen Given表示:“瑞士央行的行动增加了其他10国集团央行的压力,要求它们比预期更快地降息,但鉴于美联储主席鲍威尔昨天刚刚就维持利率不变的决定发表讲话,其他货币正在下跌,而美元则保持强势。鲍威尔的言论看起来比市场最初理解的更为鹰派,因此美元从中受益。”

Monex外汇交易员Helen Given表示:“瑞士央行的行动增加了其他10国集团央行的压力,要求它们比预期更快地降息,但鉴于美联储主席鲍威尔昨天刚刚就维持利率不变的决定发表讲话,其他货币正在下跌,而美元则保持强势。鲍威尔的言论看起来比市场最初理解的更为鹰派,因此美元从中受益。”