Troy Information Technology Co., Ltd. (SZSE:300366) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.2% over the last year.

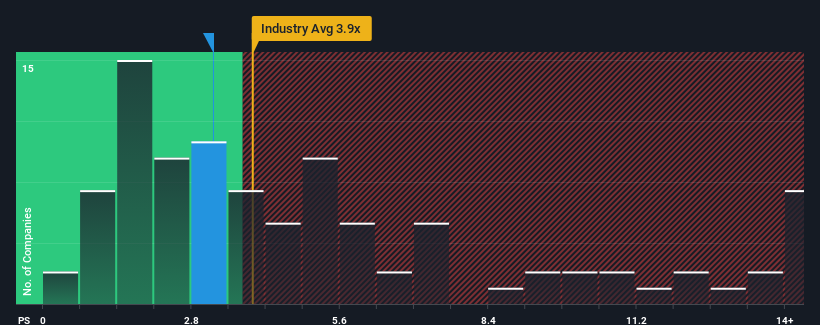

Although its price has surged higher, there still wouldn't be many who think Troy Information Technology's price-to-sales (or "P/S") ratio of 3.2x is worth a mention when the median P/S in China's IT industry is similar at about 3.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Troy Information Technology's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Troy Information Technology has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Troy Information Technology's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Troy Information Technology's to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Troy Information Technology's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 35% gain to the company's top line. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to climb by 31% during the coming year according to the only analyst following the company. With the industry predicted to deliver 41% growth, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Troy Information Technology's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Troy Information Technology's P/S

Troy Information Technology's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at the analysts forecasts of Troy Information Technology's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Troy Information Technology (1 is significant) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.