Easy Smart Group Holdings Limited's (HKG:2442 ) stock didn't jump after it announced some healthy earnings. We did some digging and believe investors may be worried about some underlying factors in the report.

Zooming In On Easy Smart Group Holdings' Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

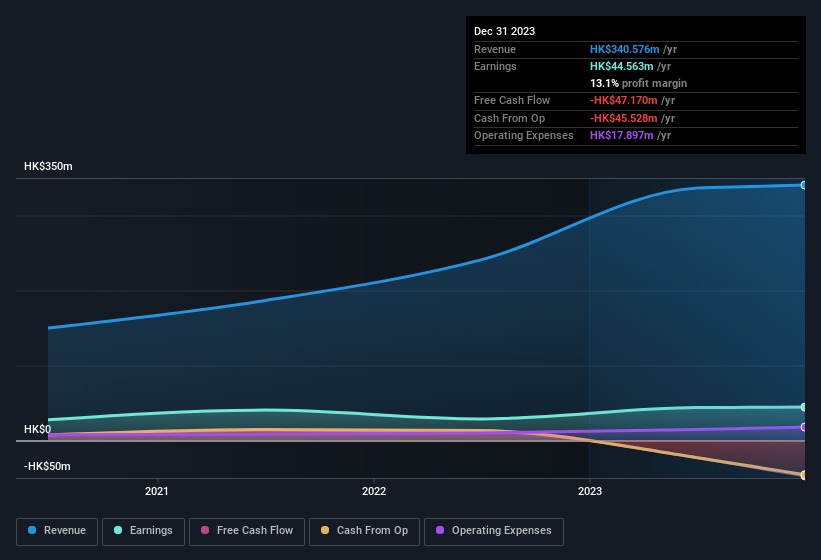

Easy Smart Group Holdings has an accrual ratio of 0.69 for the year to December 2023. Statistically speaking, that's a real negative for future earnings. And indeed, during the period the company didn't produce any free cash flow whatsoever. Even though it reported a profit of HK$44.6m, a look at free cash flow indicates it actually burnt through HK$47m in the last year. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of HK$47m, this year, indicates high risk.

Easy Smart Group Holdings has an accrual ratio of 0.69 for the year to December 2023. Statistically speaking, that's a real negative for future earnings. And indeed, during the period the company didn't produce any free cash flow whatsoever. Even though it reported a profit of HK$44.6m, a look at free cash flow indicates it actually burnt through HK$47m in the last year. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of HK$47m, this year, indicates high risk.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Easy Smart Group Holdings.

Our Take On Easy Smart Group Holdings' Profit Performance

As we discussed above, we think Easy Smart Group Holdings' earnings were not supported by free cash flow, which might concern some investors. As a result, we think it may well be the case that Easy Smart Group Holdings' underlying earnings power is lower than its statutory profit. But at least holders can take some solace from the 7.6% per annum growth in EPS for the last three. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So while earnings quality is important, it's equally important to consider the risks facing Easy Smart Group Holdings at this point in time. Every company has risks, and we've spotted 2 warning signs for Easy Smart Group Holdings (of which 1 doesn't sit too well with us!) you should know about.

This note has only looked at a single factor that sheds light on the nature of Easy Smart Group Holdings' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.