Ideally, your overall portfolio should beat the market average. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Wing Tai Properties Limited (HKG:369) shareholders for doubting their decision to hold, with the stock down 63% over a half decade. And it's not just long term holders hurting, because the stock is down 37% in the last year. Furthermore, it's down 23% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

If the past week is anything to go by, investor sentiment for Wing Tai Properties isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Wing Tai Properties isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Wing Tai Properties saw its revenue increase by 22% per year. That's well above most other pre-profit companies. In contrast, the share price is has averaged a loss of 10% per year - that's quite disappointing. It's safe to say investor expectations are more grounded now. Given the revenue growth we'd consider the stock to be quite an interesting prospect if the company has a clear path to profitability.

In the last half decade, Wing Tai Properties saw its revenue increase by 22% per year. That's well above most other pre-profit companies. In contrast, the share price is has averaged a loss of 10% per year - that's quite disappointing. It's safe to say investor expectations are more grounded now. Given the revenue growth we'd consider the stock to be quite an interesting prospect if the company has a clear path to profitability.

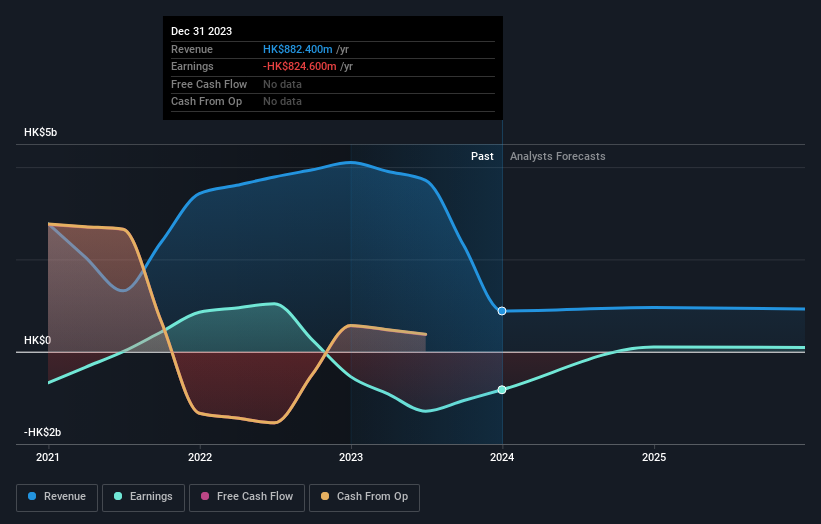

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on Wing Tai Properties

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Wing Tai Properties, it has a TSR of -49% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that Wing Tai Properties shareholders are down 32% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 8.5%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Wing Tai Properties better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Wing Tai Properties , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.