Further Weakness as Compass Minerals International (NYSE:CMP) Drops 19% This Week, Taking Three-year Losses to 76%

Further Weakness as Compass Minerals International (NYSE:CMP) Drops 19% This Week, Taking Three-year Losses to 76%

Every investor on earth makes bad calls sometimes. But really big losses can really drag down an overall portfolio. So spare a thought for the long term shareholders of Compass Minerals International, Inc. (NYSE:CMP); the share price is down a whopping 77% in the last three years. That would certainly shake our confidence in the decision to own the stock. The more recent news is of little comfort, with the share price down 54% in a year. Shareholders have had an even rougher run lately, with the share price down 45% in the last 90 days.

地球上的每個投資者有時都會打壞電話。但是,巨額虧損確實會拖累整個投資組合。因此,不用考慮康帕斯礦業國際有限公司(紐約證券交易所代碼:CMP)的長期股東了;股價在過去三年中下跌了77%。這肯定會動搖我們對擁有該股決定的信心。最近的消息並不令人欣慰,股價在一年內下跌了54%。股東們最近的表現更加艱難,股價在過去90天中下跌了45%。

Since Compass Minerals International has shed US$142m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

由於康帕斯礦業國際在過去7天內已從其價值下跌了1.42億美元,因此讓我們看看長期下跌是否是由該業務的經濟推動的。

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

不可否認,市場有時是有效的,但價格並不總是能反映潛在的業務表現。考慮市場對公司的看法發生了怎樣的變化的一種不完美但簡單的方法是將每股收益(EPS)的變化與股價走勢進行比較。

We know that Compass Minerals International has been profitable in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics might give us a better handle on how its value is changing over time.

我們知道康帕斯礦業國際過去一直盈利。另一方面,它報告了過去十二個月的虧損,這表明它無法可靠地盈利。其他指標可能會讓我們更好地了解其價值如何隨着時間的推移而變化。

It's quite likely that the declining dividend has caused some investors to sell their shares, pushing the price lower in the process. It doesn't seem like the changes in revenue would have impacted the share price much, but a closer inspection of the data might reveal something.

股息下降很可能導致一些投資者拋售股票,在此過程中推動價格走低。收入的變化似乎不會對股價產生太大影響,但仔細檢查數據可能會發現一些東西。

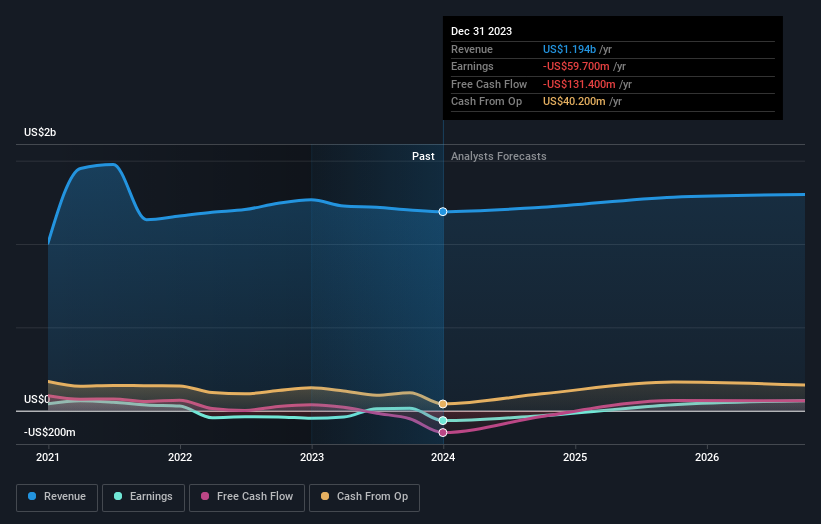

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

下圖描述了收入和收入隨時間推移而發生的變化(點擊圖片即可顯示確切的數值)。

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. You can see what analysts are predicting for Compass Minerals International in this interactive graph of future profit estimates.

可能值得注意的是,我們在上個季度看到了大量的內幕買盤,我們認爲這是積極的。另一方面,我們認爲收入和收益趨勢是衡量業務的更有意義的指標。在這張未來利潤估計的交互式圖表中,你可以看到分析師對康帕斯礦業國際的預測。

A Different Perspective

不同的視角

Compass Minerals International shareholders are down 52% for the year (even including dividends), but the market itself is up 32%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Compass Minerals International better, we need to consider many other factors. Even so, be aware that Compass Minerals International is showing 2 warning signs in our investment analysis , you should know about...

康帕斯礦業國際的股東今年下跌了52%(甚至包括股息),但市場本身上漲了32%。但是,請記住,即使是最好的股票有時也會在十二個月內表現不如市場。遺憾的是,去年的業績結束了糟糕的表現,股東在五年內每年面臨11%的總虧損。總的來說,長期股價疲軟可能是一個壞兆頭,儘管逆勢投資者可能希望研究該股以期出現轉機。長期跟蹤股價表現總是很有意思的。但是,爲了更好地了解康帕斯礦業國際,我們需要考慮許多其他因素。即便如此,請注意,康帕斯礦業國際在我們的投資分析中顯示了兩個警告信號,你應該知道...

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

還有很多其他公司有內部人士購買股票。你可能不想錯過這份業內人士正在收購的成長型公司的免費名單。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

請注意,本文引用的市場回報反映了目前在美國交易所交易的股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

We know that Compass Minerals International has been profitable in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics might give us a better handle on how its value is changing over time.

We know that Compass Minerals International has been profitable in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics might give us a better handle on how its value is changing over time.