Many Still Looking Away From Chongqing Iron & Steel Company Limited (HKG:1053)

Many Still Looking Away From Chongqing Iron & Steel Company Limited (HKG:1053)

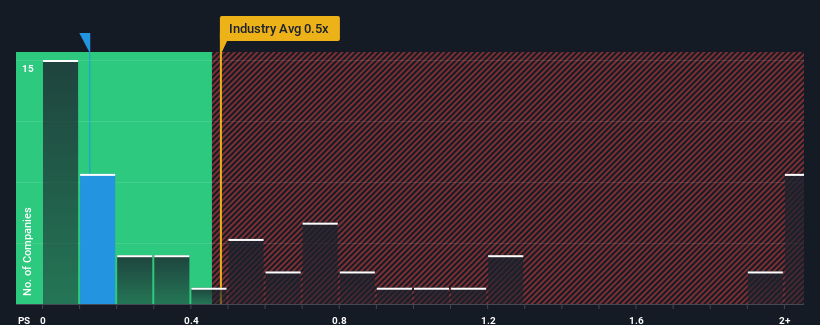

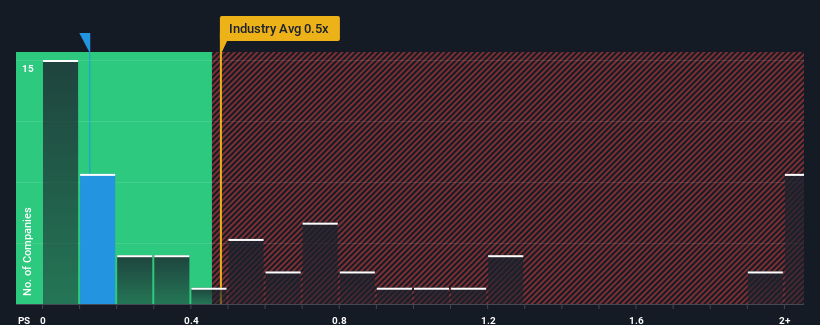

With a median price-to-sales (or "P/S") ratio of close to 0.5x in the Metals and Mining industry in Hong Kong, you could be forgiven for feeling indifferent about Chongqing Iron & Steel Company Limited's (HKG:1053) P/S ratio of 0.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Chongqing Iron & Steel Has Been Performing

Chongqing Iron & Steel has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Chongqing Iron & Steel will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Chongqing Iron & Steel will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Chongqing Iron & Steel's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 21% gain to the company's top line. Pleasingly, revenue has also lifted 70% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Retrospectively, the last year delivered an exceptional 21% gain to the company's top line. Pleasingly, revenue has also lifted 70% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 7.6% shows it's noticeably more attractive.

In light of this, it's curious that Chongqing Iron & Steel's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Chongqing Iron & Steel's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To our surprise, Chongqing Iron & Steel revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

You always need to take note of risks, for example - Chongqing Iron & Steel has 1 warning sign we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

由於香港金屬和採礦業的中位數(或 “市銷率”)比率接近0.5倍,你對重慶鋼鐵股份有限公司(HKG: 1053)0.1倍的市銷率漠不關心是可以原諒的。但是,不加解釋地忽略市銷率是不明智的,因爲投資者可能會忽視一個明顯的機會或一個代價高昂的錯誤。

重慶鋼鐵的表現如何

重慶鋼鐵最近表現良好,收入穩步增長。一種可能性是市銷率適中,因爲投資者認爲這種可觀的收入增長可能不足以在不久的將來跑贏整個行業。那些看好重慶鋼鐵的人會希望情況並非如此,這樣他們就可以以較低的估值買入該股。

想全面了解公司的收益、收入和現金流嗎?那麼我們的免費重慶鋼鐵報告將幫助您了解重慶鋼鐵的歷史表現。收入增長指標告訴我們有關市銷率的哪些信息?

人們固有的假設是,公司應該與行業相匹配,使重慶鋼鐵這樣的市銷率被認爲是合理的。

回顧過去,去年的公司收入實現了21%的驚人增長。令人高興的是,得益於過去12個月的增長,總收入也比三年前增長了70%。因此,股東們肯定會對這些中期收入增長率表示歡迎。

回顧過去,去年的公司收入實現了21%的驚人增長。令人高興的是,得益於過去12個月的增長,總收入也比三年前增長了70%。因此,股東們肯定會對這些中期收入增長率表示歡迎。

將最近的中期收入軌跡與該行業7.6%的年度增長預測進行比較,可以看出該行業明顯更具吸引力。

有鑑於此,奇怪的是,重慶鋼鐵的市銷率與其他大部分公司持平。顯然,一些股東認爲最近的表現已達到極限,並一直在接受較低的銷售價格。

重慶鋼鐵市銷率的底線

我們可以說,市銷比率的力量主要不是作爲一種估值工具,而是用來衡量當前的投資者情緒和未來預期。

令我們驚訝的是,重慶鋼鐵透露,其三年收入趨勢對市銷率的貢獻沒有我們預期的那麼大,因爲這些趨勢看起來好於當前的行業預期。可能存在一些未觀察到的收入威脅,使市銷售率無法與這種積極表現相提並論。如果最近的中期收入趨勢持續下去,至少價格下跌的風險似乎有所減弱,但投資者似乎認爲未來的收入可能會出現一些波動。

你需要時刻注意風險,例如——重慶鋼鐵有1個我們認爲你應該注意的警告標誌。

當然,具有良好收益增長曆史的盈利公司通常是更安全的選擇。因此,您可能希望看到這些免費收集的市盈率合理且收益增長強勁的其他公司。

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧