To the annoyance of some shareholders, TBK & Sons Holdings Limited (HKG:1960) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 41% share price drop.

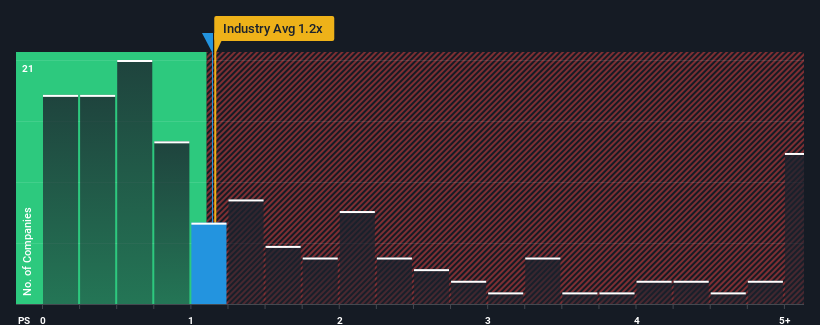

Even after such a large drop in price, given close to half the companies operating in Hong Kong's Energy Services industry have price-to-sales ratios (or "P/S") below 0.3x, you may still consider TBK & Sons Holdings as a stock to potentially avoid with its 1.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does TBK & Sons Holdings' Recent Performance Look Like?

For example, consider that TBK & Sons Holdings' financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for TBK & Sons Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is TBK & Sons Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as TBK & Sons Holdings' is when the company's growth is on track to outshine the industry.

The only time you'd be truly comfortable seeing a P/S as high as TBK & Sons Holdings' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 84% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 39% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 16% shows it's noticeably less attractive.

With this information, we find it concerning that TBK & Sons Holdings is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

Despite the recent share price weakness, TBK & Sons Holdings' P/S remains higher than most other companies in the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that TBK & Sons Holdings currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You need to take note of risks, for example - TBK & Sons Holdings has 3 warning signs (and 2 which are significant) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.