Sino-Ocean Service Holding Limited (HKG:6677) shareholders that were waiting for something to happen have been dealt a blow with a 32% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 74% loss during that time.

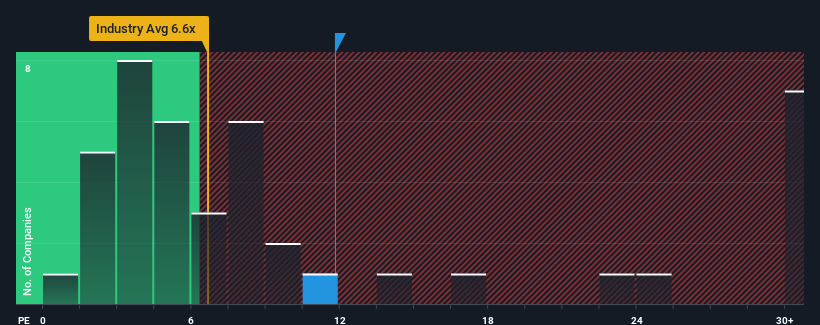

In spite of the heavy fall in price, given around half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 8x, you may still consider Sino-Ocean Service Holding as a stock to potentially avoid with its 11.8x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Sino-Ocean Service Holding hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Sino-Ocean Service Holding's is when the company's growth is on track to outshine the market.

The only time you'd be truly comfortable seeing a P/E as high as Sino-Ocean Service Holding's is when the company's growth is on track to outshine the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 43%. This means it has also seen a slide in earnings over the longer-term as EPS is down 88% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 515% as estimated by the two analysts watching the company. With the market only predicted to deliver 21%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Sino-Ocean Service Holding's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Sino-Ocean Service Holding's P/E?

Sino-Ocean Service Holding's P/E hasn't come down all the way after its stock plunged. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Sino-Ocean Service Holding's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Sino-Ocean Service Holding (1 shouldn't be ignored!) that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.