The Shanghai Kelai Mechatronics Engineering Co.,Ltd. (SHSE:603960) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 51%, which is great even in a bull market.

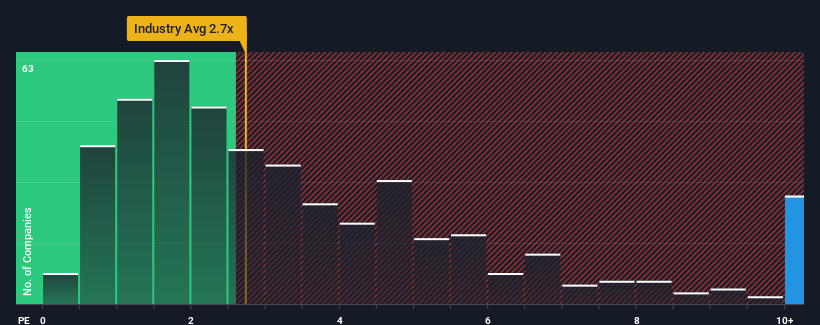

In spite of the heavy fall in price, given around half the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 2.7x, you may still consider Shanghai Kelai Mechatronics EngineeringLtd as a stock to avoid entirely with its 12.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Shanghai Kelai Mechatronics EngineeringLtd's Recent Performance Look Like?

Recent revenue growth for Shanghai Kelai Mechatronics EngineeringLtd has been in line with the industry. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Shanghai Kelai Mechatronics EngineeringLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Shanghai Kelai Mechatronics EngineeringLtd would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 21% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 49% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 27%, which is noticeably less attractive.

With this information, we can see why Shanghai Kelai Mechatronics EngineeringLtd is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Shanghai Kelai Mechatronics EngineeringLtd's P/S Mean For Investors?

A significant share price dive has done very little to deflate Shanghai Kelai Mechatronics EngineeringLtd's very lofty P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Shanghai Kelai Mechatronics EngineeringLtd shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about this 1 warning sign we've spotted with Shanghai Kelai Mechatronics EngineeringLtd.

If these risks are making you reconsider your opinion on Shanghai Kelai Mechatronics EngineeringLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.