Xinxiang Chemical Fiber Co., Ltd. (SZSE:000949) shareholders should be happy to see the share price up 23% in the last month. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 23% in the last three years, significantly under-performing the market.

The recent uptick of 11% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Because Xinxiang Chemical Fiber made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Xinxiang Chemical Fiber grew revenue at 5.4% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. The stock dropped 7% during that time. If revenue growth accelerates, we might see the share price bounce. But ultimately the key will be whether the company can become profitability.

Over three years, Xinxiang Chemical Fiber grew revenue at 5.4% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. The stock dropped 7% during that time. If revenue growth accelerates, we might see the share price bounce. But ultimately the key will be whether the company can become profitability.

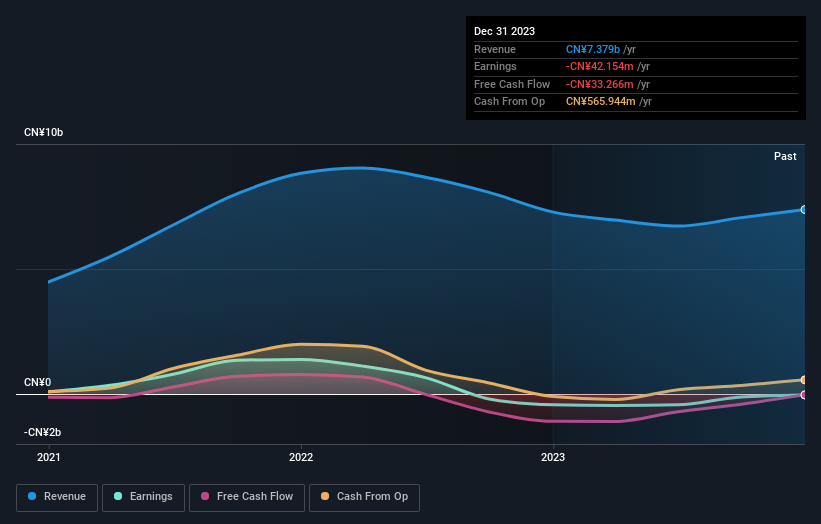

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Xinxiang Chemical Fiber's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Xinxiang Chemical Fiber's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Xinxiang Chemical Fiber's TSR of was a loss of 20% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While it's certainly disappointing to see that Xinxiang Chemical Fiber shares lost 1.2% throughout the year, that wasn't as bad as the market loss of 14%. Given the total loss of 0.4% per year over five years, it seems returns have deteriorated in the last twelve months. Whilst Baron Rothschild does tell the investor "buy when there's blood in the streets, even if the blood is your own", buyers would need to examine the data carefully to be comfortable that the business itself is sound. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Xinxiang Chemical Fiber you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.