To the annoyance of some shareholders, Sunlight (1977) Holdings Limited (HKG:8451) shares are down a considerable 25% in the last month, which continues a horrid run for the company. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

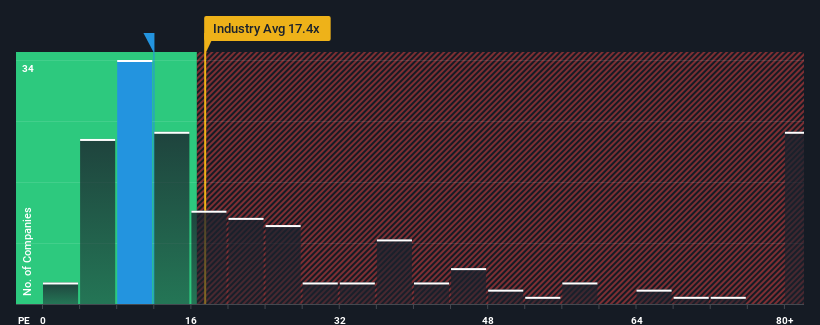

In spite of the heavy fall in price, Sunlight (1977) Holdings may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 11.9x, since almost half of all companies in Hong Kong have P/E ratios under 9x and even P/E's lower than 5x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Sunlight (1977) Holdings certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Sunlight (1977) Holdings would need to produce impressive growth in excess of the market.

In order to justify its P/E ratio, Sunlight (1977) Holdings would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered an exceptional 150% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 64% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 21% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that Sunlight (1977) Holdings' P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Sunlight (1977) Holdings' P/E?

Sunlight (1977) Holdings' P/E hasn't come down all the way after its stock plunged. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Sunlight (1977) Holdings currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware Sunlight (1977) Holdings is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If these risks are making you reconsider your opinion on Sunlight (1977) Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.