Nanjing Hanrui Cobalt Co.,Ltd. (SZSE:300618) shares have had a really impressive month, gaining 40% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 22% over that time.

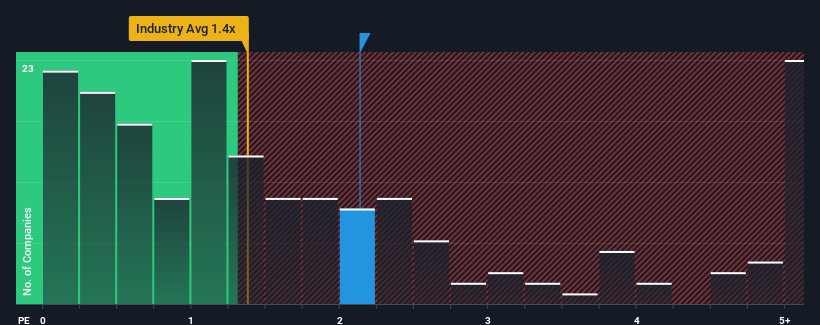

After such a large jump in price, when almost half of the companies in China's Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Nanjing Hanrui CobaltLtd as a stock probably not worth researching with its 2.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does Nanjing Hanrui CobaltLtd's Recent Performance Look Like?

For instance, Nanjing Hanrui CobaltLtd's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Nanjing Hanrui CobaltLtd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Nanjing Hanrui CobaltLtd's to be considered reasonable.

There's an inherent assumption that a company should outperform the industry for P/S ratios like Nanjing Hanrui CobaltLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.1%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 121% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is only predicted to deliver 14% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Nanjing Hanrui CobaltLtd's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does Nanjing Hanrui CobaltLtd's P/S Mean For Investors?

The large bounce in Nanjing Hanrui CobaltLtd's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Nanjing Hanrui CobaltLtd can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 4 warning signs for Nanjing Hanrui CobaltLtd (1 shouldn't be ignored!) that you should be aware of.

If you're unsure about the strength of Nanjing Hanrui CobaltLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.