Zhidao International (Holdings) Limited (HKG:1220) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 119% in the last twelve months.

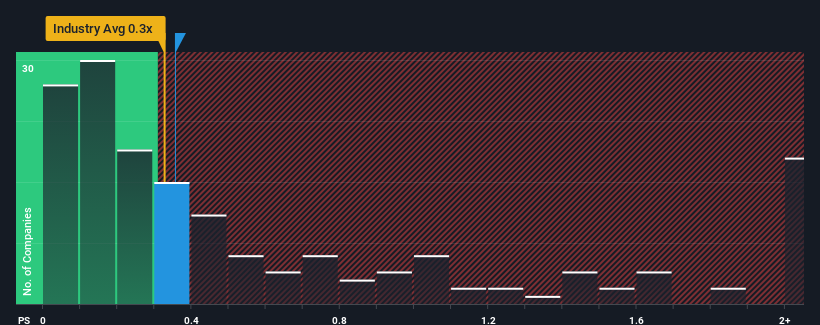

Although its price has dipped substantially, there still wouldn't be many who think Zhidao International (Holdings)'s price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Hong Kong's Construction industry is similar at about 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Zhidao International (Holdings) Has Been Performing

With revenue growth that's exceedingly strong of late, Zhidao International (Holdings) has been doing very well. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Zhidao International (Holdings) will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

Zhidao International (Holdings)'s P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Zhidao International (Holdings)'s P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 206% gain to the company's top line. Pleasingly, revenue has also lifted 300% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 9.5% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Zhidao International (Holdings) is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

Following Zhidao International (Holdings)'s share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To our surprise, Zhidao International (Holdings) revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Before you settle on your opinion, we've discovered 3 warning signs for Zhidao International (Holdings) (1 makes us a bit uncomfortable!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.