Dr. Peng Telecom & Media Group Co., Ltd. (SHSE:600804) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.2% over the last year.

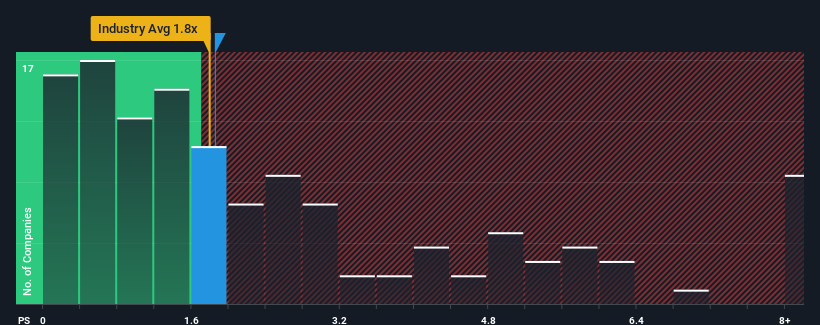

Although its price has surged higher, considering about half the companies operating in China's Telecom industry have price-to-sales ratios (or "P/S") above 4.1x, you may still consider Dr. Peng Telecom & Media Group as an great investment opportunity with its 1.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

How Has Dr. Peng Telecom & Media Group Performed Recently?

There hasn't been much to differentiate Dr. Peng Telecom & Media Group's and the industry's revenue growth lately. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. Those who are bullish on Dr. Peng Telecom & Media Group will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on Dr. Peng Telecom & Media Group will help you uncover what's on the horizon.How Is Dr. Peng Telecom & Media Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Dr. Peng Telecom & Media Group's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 36% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 5.8% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 20%, which is noticeably more attractive.

With this information, we can see why Dr. Peng Telecom & Media Group is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Dr. Peng Telecom & Media Group's P/S Mean For Investors?

Shares in Dr. Peng Telecom & Media Group have risen appreciably however, its P/S is still subdued. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Dr. Peng Telecom & Media Group's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Dr. Peng Telecom & Media Group you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.