Jiangsu Teeyer Intelligent Equipment Co.,Ltd. (SHSE:603273) shares have had a horrible month, losing 31% after a relatively good period beforehand. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

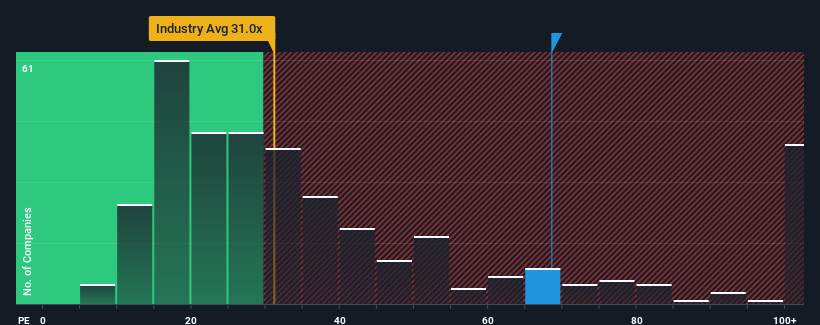

In spite of the heavy fall in price, Jiangsu Teeyer Intelligent EquipmentLtd may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 68.5x, since almost half of all companies in China have P/E ratios under 31x and even P/E's lower than 19x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

The earnings growth achieved at Jiangsu Teeyer Intelligent EquipmentLtd over the last year would be more than acceptable for most companies. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Jiangsu Teeyer Intelligent EquipmentLtd's to be considered reasonable.

There's an inherent assumption that a company should far outperform the market for P/E ratios like Jiangsu Teeyer Intelligent EquipmentLtd's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 10%. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 17% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 36% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Jiangsu Teeyer Intelligent EquipmentLtd is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Jiangsu Teeyer Intelligent EquipmentLtd's P/E?

Even after such a strong price drop, Jiangsu Teeyer Intelligent EquipmentLtd's P/E still exceeds the rest of the market significantly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Jiangsu Teeyer Intelligent EquipmentLtd currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with Jiangsu Teeyer Intelligent EquipmentLtd.

If these risks are making you reconsider your opinion on Jiangsu Teeyer Intelligent EquipmentLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.