宏观大势

美国 3 月非农就业人数 +303K ,预期 +200K。

美国 3 月非农就业人数增长 +303K 人,预期 +214K 人。这一强劲势头强化了美联储近期关于利率将持续走高的口号。3 月份失业率为 3.8%,预期为 3.8%,2 月份为 3.9%。平均时薪月率为 +0.3%,年率为 4.1%(均与预期相同)。

2 月份 JOLTS 职位空缺数增至 875 万个

美国劳工部劳工统计局(Bureau of Labor Statistics)称,2 月份最后一天,衡量劳动力需求的职位空缺数增加了 8000 个,达到 875.6 万个。1月份的数据经修正后为874.8万个未填补职位,而不是之前报告的886.3万个。

美国劳工部劳工统计局(Bureau of Labor Statistics)称,2 月份最后一天,衡量劳动力需求的职位空缺数增加了 8000 个,达到 875.6 万个。1月份的数据经修正后为874.8万个未填补职位,而不是之前报告的886.3万个。

与二月份相比,三月份的二手车价格有所下降。

曼海姆二手车价值指数(MUVVI)降至 203.1,同比下降 14.7%。

资金动向

金价创历史新高,超过 2300 美元,专家称还没完

周三(4 月 3 日),黄金现货价格再创新高,触及每盎司 2313.50 美元。

尽管地缘政治忧虑和央行的强劲买盘帮助压低了金价,但许多专家认为,一旦美联储开始降息,金价将真正开始走高。Neptune Global总裁克里斯-布拉西(Chris Blasi)说,他认为贵金属正处于20年牛市的第三段。"这一段将会出现贵金属投资者群体中很多人期待了十多年的回报"。

多家投资银行已搭乘铜价快车。

巴拿马一座大型铜矿的关闭等停产造成的供应紧缩与强劲的需求相结合,使铜价重新回到每磅 9000 美元的关口,并有可能再上涨 22%,达到创纪录的每磅 11000 美元。

摩根士丹利(Morgan Stanley)认为,铜市场供需紧张的基本面已将该金属提升至其首选商品的首位。

"摩根士丹利表示:"由于对出现巨额赤字的预期加快,铜价自 8 月份以来首次突破 8700 美元/吨。"我们继续看好铜价,预计到 2024 年第三季度铜价将达到 10200 美元/吨。

公司新闻

报道称特斯拉放弃低成本汽车计划,埃隆-马斯克否认这一说法。

特斯拉周五盘中走低,此前有报道称这家电动汽车制造商在中国市场的竞争中放弃了低成本汽车计划。

据路透社独家报道,特斯拉已经取消了其备受期待的平价汽车的生产计划,这偏离了首席执行官埃隆-马斯克(Elon Musk)的初衷--为更多人创造电动汽车。

报道还说,这一决定削弱了特斯拉扩大市场覆盖面的希望,标志着公司将重点转向在同一汽车平台上开发自动驾驶机器人。

有趣的是,马斯克在其最新的推文中对该报道的可信度提出了质疑。

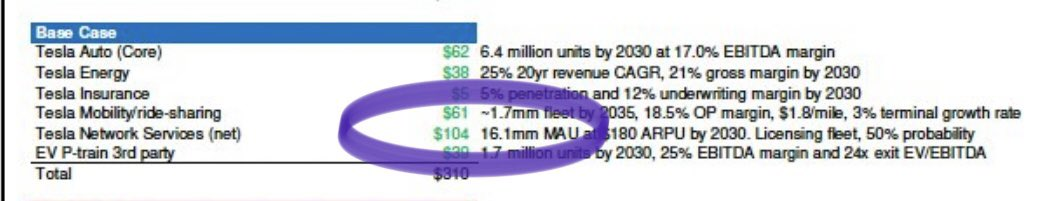

摩根士丹利(Morgan Stanley)将特斯拉 310 美元的目标价中的 104 美元定为 FSD 授权估值。

投资银行开始将 FSD 授权交易的几率增加视为 TSLA 估值的主要因素。MS 的乔纳斯现在将特斯拉 310 美元的目标价中仅 62 美元/股归因于核心汽车业务,而将 104 美元/股归因于第三方授权交易(他假设 1610 万 MAUs 的 ARPU 值为 180 美元)。

特斯拉销量创历史之最,电动汽车遭受重创。

特斯拉今年前三个月的汽车交付量仅为 386,810 辆,与彭博社的平均预期相差甚远,这是七年来的最大差距。特斯拉股价周二在纽约下跌 4.9%,将 2024 年的跌幅扩大至 33%,在标准普尔 500 指数中排名第二。

英伟达计划在印尼建立价值2亿美元的人工智能中心,进军东南亚市场

英伟达(Nvidia)计划与当地电信巨头Indosat Ooredoo Hutchison合作,在印度尼西亚建立一个价值2亿美元的人工智能中心,作为美国科技界的宠儿,英伟达将继续进军东南亚市场。

随着数字经济的发展,东南亚地区的数据需求急剧增长,Nvidia 在印尼的业务增长代表着该公司今年将更广泛地进军东南亚市场。

今年1月,新加坡电信运营商新加坡电信(Singtel)宣布与英伟达(Nvidia)合作,在东南亚地区的数据中心部署人工智能功能。

内容仅用作提供信息及教育之目的,不构成对任何特定证券或投资策略的推荐或认可。本内容中的信息仅用于说明目的,可能不适用于所有投资者。本内容未考虑任何特定人士的投资目标、财务状况或需求,并不应被视作个人投资建议。建议您在做出任何投资于任何资本市场产品的决定之前,应考虑您的个人情况判断信息的适当性。过去的投资表现不能保证未来的结果。投资涉及风险和损失本金的可能性。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。