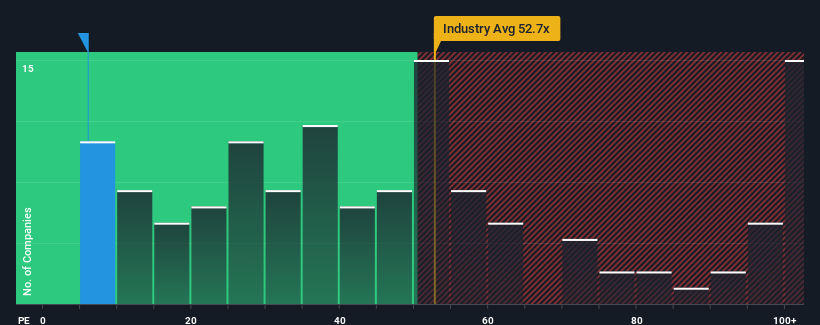

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 32x, you may consider TCL Zhonghuan Renewable Energy Technology Co.,Ltd. (SZSE:002129) as a highly attractive investment with its 6x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for TCL Zhonghuan Renewable Energy TechnologyLtd as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as TCL Zhonghuan Renewable Energy TechnologyLtd's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 28% last year. Pleasingly, EPS has also lifted 573% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Taking a look back first, we see that the company grew earnings per share by an impressive 28% last year. Pleasingly, EPS has also lifted 573% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 7.4% per year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 20% per year, which is noticeably more attractive.

With this information, we can see why TCL Zhonghuan Renewable Energy TechnologyLtd is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that TCL Zhonghuan Renewable Energy TechnologyLtd maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for TCL Zhonghuan Renewable Energy TechnologyLtd (2 are concerning!) that we have uncovered.

If you're unsure about the strength of TCL Zhonghuan Renewable Energy TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.