Unfortunately for some shareholders, the Luk Hing Entertainment Group Holdings Limited (HKG:8052) share price has dived 33% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 76% share price decline.

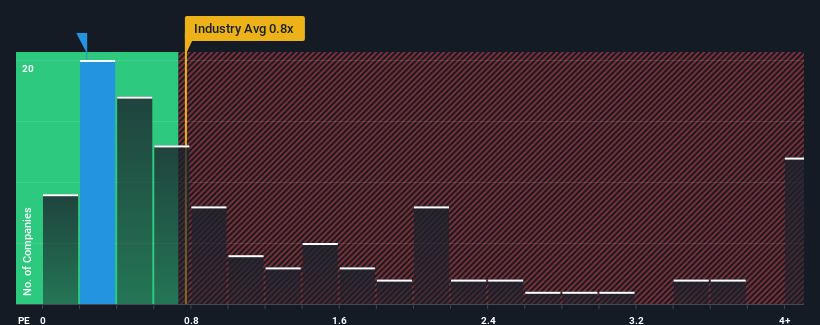

Since its price has dipped substantially, Luk Hing Entertainment Group Holdings may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Hospitality industry in Hong Kong have P/S ratios greater than 0.8x and even P/S higher than 3x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Luk Hing Entertainment Group Holdings Has Been Performing

Luk Hing Entertainment Group Holdings certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Luk Hing Entertainment Group Holdings' earnings, revenue and cash flow.How Is Luk Hing Entertainment Group Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Luk Hing Entertainment Group Holdings would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Luk Hing Entertainment Group Holdings would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 64% last year. Still, revenue has fallen 41% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 20% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we understand why Luk Hing Entertainment Group Holdings' P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Key Takeaway

Luk Hing Entertainment Group Holdings' P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Luk Hing Entertainment Group Holdings confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 6 warning signs for Luk Hing Entertainment Group Holdings you should be aware of, and 3 of them can't be ignored.

If these risks are making you reconsider your opinion on Luk Hing Entertainment Group Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.