Nvidia Stock Trading At 13% Discount To Long-Term Average, Other AI Stocks At 52% Premium

Nvidia Stock Trading At 13% Discount To Long-Term Average, Other AI Stocks At 52% Premium

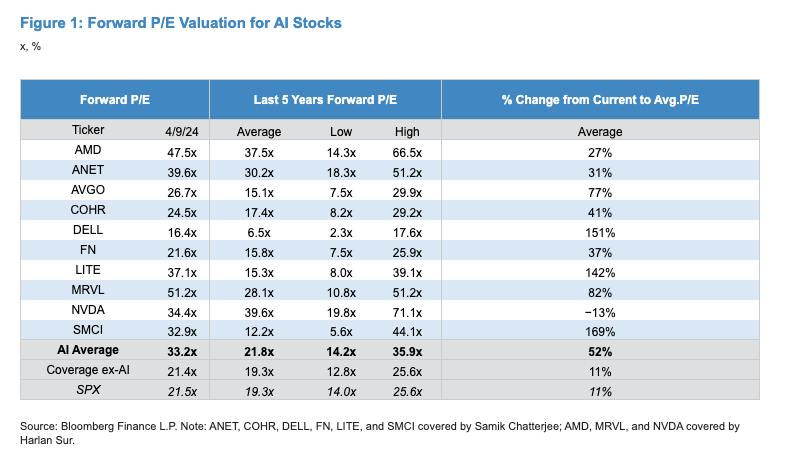

Nvidia Corp (NASDAQ:NVDA) traded 13% below its five-year average as of April 9 while nine other artificial intelligence-related stocks were trading above their five-year average.

截至4月9日,英偉達公司(納斯達克股票代碼:NVDA)的交易價格比其五年平均水平低13%,而其他九隻與人工智能相關的股票的交易價格高於其五年平均水平。

The AI average of all 10 stocks is trading at a 52% premium, according to an analyst note from JPMorgan's Samik Chatterjee, citing data from Bloomberg.

摩根大通的薩米克·查特吉援引彭博社數據的一份分析師報告顯示,所有10只股票的人工智能平均交易價格爲52%。

See below.

見下文。

Table source: JPMorgan analyst note

表格來源:摩根大通分析師報告

As can be seen in the table above:

從上表中可以看出:

- Super Micro Computer (NASDAQ:SMCI) leads the pack with its stock price trading at a 169% premium to its long-term average.

- Dell Technologies (NYSE:DELL) follows next at 151% premium

- Lumentum Holdings (NASDAQ:LITE) follow at 142%

- Marvell Technologies (NASDAQ:MRVL) at 82%.

- 超級微型計算機(納斯達克股票代碼:SMCI)處於領先地位,其股價比長期平均水平高169%。

- 緊隨其後的是戴爾科技(紐約證券交易所代碼:DELL),溢價151%

- Lumentum Holdings(納斯達克股票代碼:LITE)緊隨其後 142%

- Marvell Technologies(納斯達克股票代碼:MRVL)上漲82%。

Also Read: Which Is The Most Undervalued AI5 Stock Right Now?

另請閱讀:哪隻是目前最被低估的AI5股票?

AI Stock Positioning Earnings

AI 股票定位收益

Despite the sector's growth prospects, AI stocks, on average, are trading at a 52% premium to their long-term valuation multiples.

儘管該行業有增長前景,但平均而言,人工智能股票的交易價格比其長期估值倍數高出52%。

For context, the S&P 500 Index, considered a barometer of the U.S. stock market, is currently 11% above its long-term average.

就背景而言,被認爲是美國股市晴雨表的標準普爾500指數目前比其長期平均水平高出11%。

By that measure, Nvidia, trading at 13% below its 5-year average forward P/E multiple – appears to be great pick. Advanced Micro Devices (NASDAQ:AMD) and Arista Networks (NYSE:ANET) at 27% and 31% premium, respectively, may also be offering better value than other AI stocks (ex-Nvidia).

從這個角度來看,英偉達的交易價格比其5年平均遠期市盈倍數低13%,這似乎是一個不錯的選擇。Advanced Micro Devices(納斯達克股票代碼:AMD)和Arista Networks(紐約證券交易所代碼:ANET)的溢價分別爲27%和31%,也可能比其他人工智能股票(前NVIDIA)提供更好的價值。

The premium on AI stocks' multiples right now, is definitely a dampener on enthusiasm for favorable positioning into earnings.

目前,人工智能股票倍數的溢價無疑抑制了人們對盈利有利定位的熱情。

As investors brace for first-quarter earnings, navigating macro headwinds and sector-specific dynamics is crucial. JPMorgan's insights shed light on potential opportunities and challenges in the AI sector, guiding investors in optimizing their portfolios amidst evolving market conditions.

在投資者爲第一季度的收益做準備之際,應對宏觀不利因素和特定行業的動態至關重要。摩根大通的見解揭示了人工智能領域的潛在機遇和挑戰,指導投資者在不斷變化的市場條件下優化其投資組合。

Image: Shutterstock

圖片:Shutterstock

Table source: JPMorgan analyst note

Table source: JPMorgan analyst note