Commodity prices have risen recently, and related funds have become popular.

From the perspective of commodity types, Guojin Securities classifies domestic commodity funds as precious metals funds, energy funds, and other commodity funds.

1. Gold commodity funds

Gold commodity funds are currently the largest number of domestic commodity funds, accounting for 20 of the 39 commodity funds, with a total size of 30.456 billion yuan. These include 7 funds tracking Shanghai gold, 7 funds tracking spot SGE gold 9999 on the Shanghai Gold Exchange, 2 funds tracking the CSIC Shanghai, Hong Kong and Shenzhen Gold Industry Index, 3 funds tracking London Gold, and 1 fund tracking the London Gold and Gold Mining Stock Hybrid Index.

Gold commodity funds are currently the largest number of domestic commodity funds, accounting for 20 of the 39 commodity funds, with a total size of 30.456 billion yuan. These include 7 funds tracking Shanghai gold, 7 funds tracking spot SGE gold 9999 on the Shanghai Gold Exchange, 2 funds tracking the CSIC Shanghai, Hong Kong and Shenzhen Gold Industry Index, 3 funds tracking London Gold, and 1 fund tracking the London Gold and Gold Mining Stock Hybrid Index.

Both the Shanghai Gold Index and SGE Gold 9999 are published by the Shanghai Gold Exchange. The main difference is that SGE Gold 9999 is an AU99.99 spot contract index, determined by market transactions, while the Shanghai Gold Index is priced centrally by several large financial institutions. Both are based on RMB and track changes in domestic gold prices. The difference is minimal. The London Gold Index is a gold spot price index of the London Stock Exchange. Depending on the location, there may sometimes be price differences with the price of gold on the Shanghai Stock Exchange, but the two are highly convergent.

On October 11, 2023, the first batch of domestic ETFs to invest in China Securities, Shanghai, Hong Kong, and Shenzhen gold industry stocks were officially approved. Huaxia Fund and Yongying Fund issued their own gold stock ETF funds, further improving China's commodity fund market.

Gold stocks have been more volatile than gold for a long time, and there is strong logical support for this phenomenon. The core value of gold stocks comes from factors such as resource volume, ore grade, and production capacity. The price elasticity of gold stocks is not only due to changes in current profit brought to listed companies by rising gold prices, but more importantly, exponential growth brought about by the increase in the value of the company's assets. As a more flexible target, gold stocks are more suitable to be held in an environment where the gold market is rising. Especially when the market satisfies the low overall valuation of gold stocks and is expected to be driven by upward logic, gold stock ETFs may obtain a better risk ratio than gold spot ETFs.

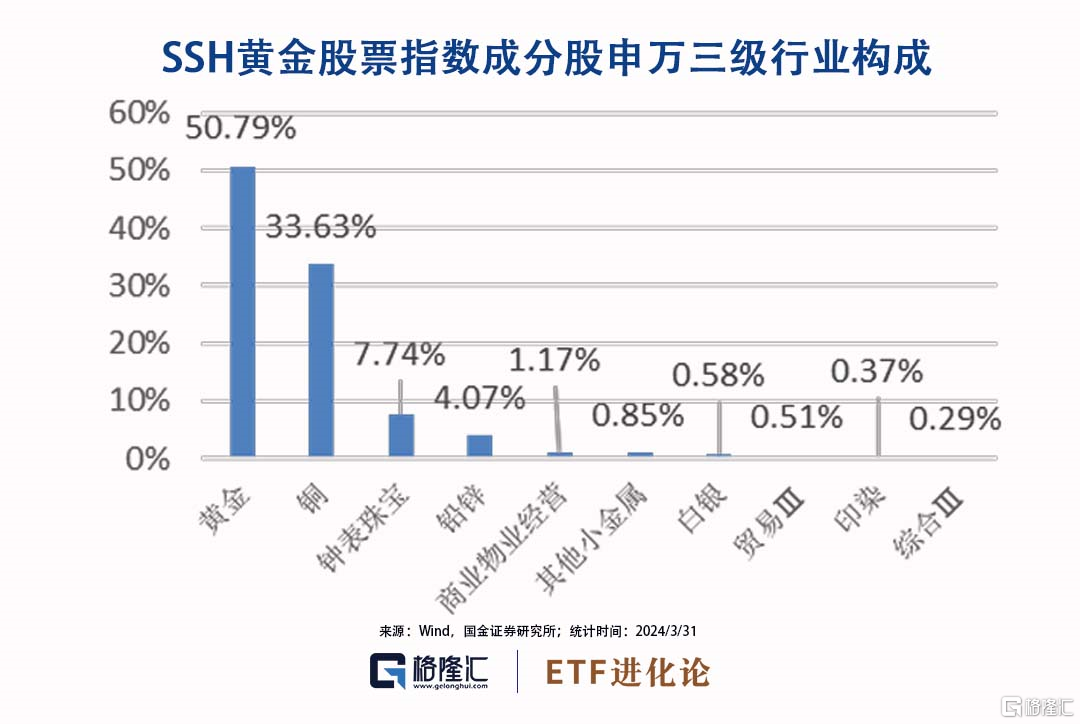

The SSH Gold Stock Index selects 50 securities of listed companies with large market capitalization and whose business involves gold mining, smelting, and sales from the mainland China and Hong Kong markets as an index sample. However, judging from the specific industry segments of its constituent stocks, Shenwan's third-tier gold constituent stocks account for only 50.79% of the index, while copper, watches, and jewelry account for 33.63% and 7.74%, respectively.

Looking at specific stocks, among the top ten constituent stocks of the SSH Gold Stock Index, Zijin Mining (and the sixth largest constituent stock is the Hong Kong stock Zijin Mining), Shenwan's third-tier industry classification is copper, and the correlation coefficient between its daily yield and the daily yield on gold prices is only 29.46%. Other third-tier stocks are classified as gold, and the correlation coefficient between daily yield and gold daily yield is only about 50%.

From the industry composition of the index, it can be seen that the SSH Gold Stock Index actually does not have a very high “gold purity”; its second-most important industry, copper, will have a certain impact on the index's performance. Judging from the specific data, there is a clear correlation between the SSH gold stock index's excess earnings compared to the AU9999 gold price and the price of continuous contracts between Shanghai Copper and Shanghai Copper in recent months. Therefore, for investment in this index, in addition to judging the price of gold, it is also possible to moderately refer to copper price expectations in order to select between gold stock ETFs and gold spot ETFs.

2. Energy commodities fund

Energy funds are currently the second largest category of domestic commodity funds. There are 11 products, with a total size of about 6.748 billion yuan. Since China's crude oil and liquefied petroleum gas futures contracts have been listed for a short time, and no natural gas contracts have been listed, and there are no investment tools to build oil and gas fund portfolios, the current energy commodity funds are mainly QDII funds, with a total of 10, of which 5 use the S&P Oil and Gas Exploration and Production Selected Industry Index as performance benchmarks. The other 5 benchmarks are the Dow Jones US Petroleum Development and Production Index, the S&P Global Net Total Income Index, the S&P Global Petroleum Net Total Income Index, the international crude oil spot price, the S&P Energy Industry Index, and the S&P Goldman Sachs Crude Oil Commodity Index. Another domestic equity ETF fund uses the China Securities, especially the Industrial Index, as a performance benchmark.

Overall, the QDII-Stock Index energy funds have a good tracking effect on their respective indices and are less correlated with crude oil, while the correlation between Yifangda crude oil and China Southern crude oil is as high as 90% with oil and US oil. (Fuguo S&P Oil and Gas Exploration and Production Select Industry ETF, Harvest S&P Oil and Gas Exploration and Production Select Industry ETF, Bosch S&P Oil and Gas Exploration and Production Select Industry Index A, and Cathay Pacific China Securities Oil and Gas Industry ETF have been established for a short time, and the correlation with crude oil is not counted here for the time being)

Judging from the correlation data, the three funds with a high correlation coefficient with the crude oil market are Harvest Crude Oil LOF, and Southern Crude Oil LOF. Their benchmarks are WTI crude oil price, S&P Goldman Sachs crude oil commodity index, 60% WTI crude oil yield +40% oil yield, all of which are the price of the commodity itself. The investment targets of these three funds are also mainly passive funds that invest in commodities overseas, so they show a strong correlation with crude oil prices. Other energy sector commodity funds mainly invest in energy-related stocks, so the correlation with crude oil price fluctuations is slightly lower.

黄金类商品基金是目前国内商品基金中数量最多的,在全部39只商品基金中占20个,合计规模304.56亿元。其中包括7只基金跟踪上海金、7只基金跟踪上海黄金交易所现货SGE黄金9999、2只基金跟踪中证沪港深黄金产业指数、3只基金跟踪伦敦金、1只基金跟踪伦敦金和金矿股混合指数。

黄金类商品基金是目前国内商品基金中数量最多的,在全部39只商品基金中占20个,合计规模304.56亿元。其中包括7只基金跟踪上海金、7只基金跟踪上海黄金交易所现货SGE黄金9999、2只基金跟踪中证沪港深黄金产业指数、3只基金跟踪伦敦金、1只基金跟踪伦敦金和金矿股混合指数。