Jiangsu Ruitai New Energy Materials (SZSE:301238) has had a great run on the share market with its stock up by a significant 28% over the last month. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to study its financial indicators more closely to see if they had a hand to play in the recent price move. Specifically, we decided to study Jiangsu Ruitai New Energy Materials' ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors' money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Jiangsu Ruitai New Energy Materials is:

6.7% = CN¥496m ÷ CN¥7.4b (Based on the trailing twelve months to December 2023).

The 'return' is the income the business earned over the last year. So, this means that for every CN¥1 of its shareholder's investments, the company generates a profit of CN¥0.07.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don't share these attributes.

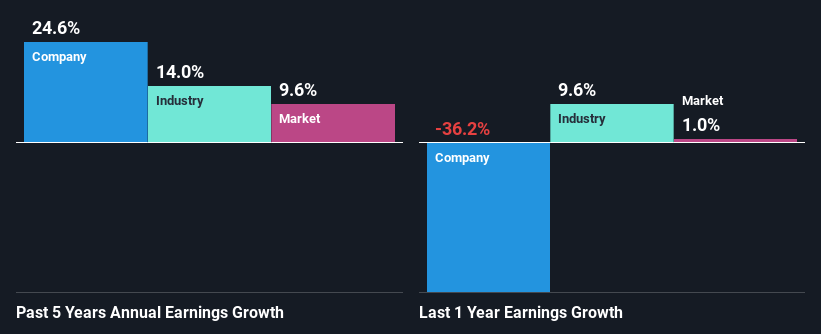

A Side By Side comparison of Jiangsu Ruitai New Energy Materials' Earnings Growth And 6.7% ROE

On the face of it, Jiangsu Ruitai New Energy Materials' ROE is not much to talk about. Yet, a closer study shows that the company's ROE is similar to the industry average of 7.1%. Moreover, we are quite pleased to see that Jiangsu Ruitai New Energy Materials' net income grew significantly at a rate of 25% over the last five years. Taking into consideration that the ROE is not particularly high, we reckon that there could also be other factors at play which could be influencing the company's growth. Such as - high earnings retention or an efficient management in place.

We then compared Jiangsu Ruitai New Energy Materials' net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 14% in the same 5-year period.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Jiangsu Ruitai New Energy Materials fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Jiangsu Ruitai New Energy Materials Using Its Retained Earnings Effectively?

Jiangsu Ruitai New Energy Materials has a really low three-year median payout ratio of 12%, meaning that it has the remaining 88% left over to reinvest into its business. This suggests that the management is reinvesting most of the profits to grow the business as evidenced by the growth seen by the company.

While Jiangsu Ruitai New Energy Materials has seen growth in its earnings, it only recently started to pay a dividend. It is most likely that the company decided to impress new and existing shareholders with a dividend.

Summary

On the whole, we do feel that Jiangsu Ruitai New Energy Materials has some positive attributes. Even in spite of the low rate of return, the company has posted impressive earnings growth as a result of reinvesting heavily into its business. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. To know the 1 risk we have identified for Jiangsu Ruitai New Energy Materials visit our risks dashboard for free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.