Huijing Holdings Company Limited (HKG:9968) shareholders won't be pleased to see that the share price has had a very rough month, dropping 35% and undoing the prior period's positive performance. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

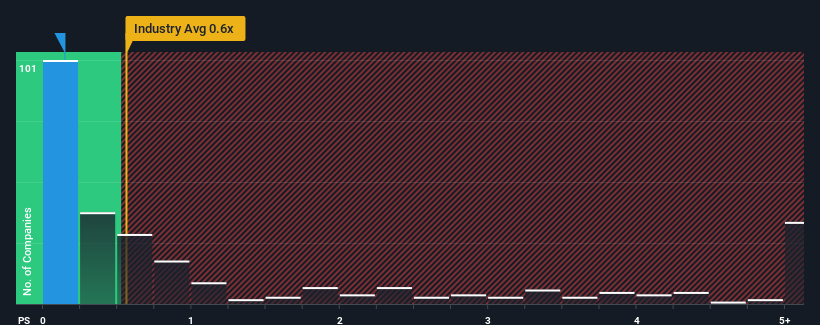

Although its price has dipped substantially, there still wouldn't be many who think Huijing Holdings' price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in Hong Kong's Real Estate industry is similar at about 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Huijing Holdings' Recent Performance Look Like?

Recent times have been quite advantageous for Huijing Holdings as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Huijing Holdings will help you shine a light on its historical performance.How Is Huijing Holdings' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Huijing Holdings' is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Huijing Holdings' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Still, revenue has fallen 82% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 4.9% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Huijing Holdings' P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Bottom Line On Huijing Holdings' P/S

With its share price dropping off a cliff, the P/S for Huijing Holdings looks to be in line with the rest of the Real Estate industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at Huijing Holdings revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Before you settle on your opinion, we've discovered 2 warning signs for Huijing Holdings (1 is potentially serious!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.