Unfortunately for some shareholders, the QuakeSafe Technologies Co., Ltd. (SZSE:300767) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 77% loss during that time.

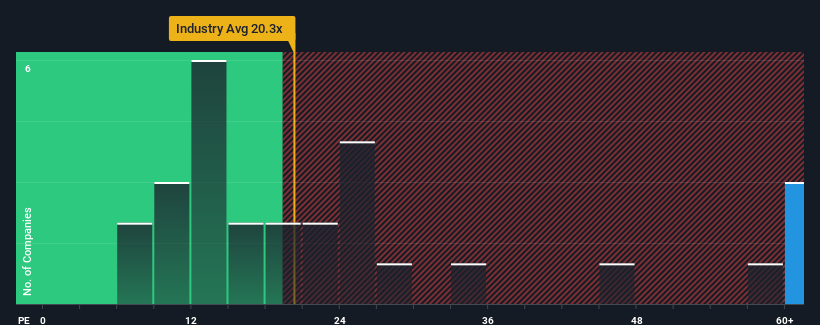

Even after such a large drop in price, QuakeSafe Technologies may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 62.8x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, QuakeSafe Technologies' earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

How Is QuakeSafe Technologies' Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like QuakeSafe Technologies' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 57%. This means it has also seen a slide in earnings over the longer-term as EPS is down 78% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 251% over the next year. Meanwhile, the rest of the market is forecast to only expand by 36%, which is noticeably less attractive.

With this information, we can see why QuakeSafe Technologies is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From QuakeSafe Technologies' P/E?

Even after such a strong price drop, QuakeSafe Technologies' P/E still exceeds the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that QuakeSafe Technologies maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for QuakeSafe Technologies you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.