Primarius Technologies Co., Ltd. (SHSE:688206) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 63% share price decline.

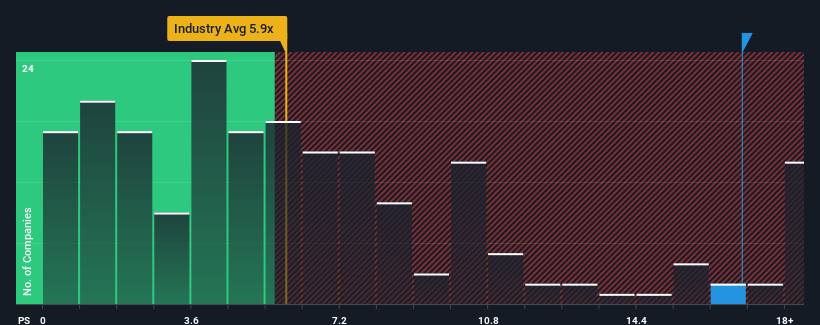

Even after such a large drop in price, Primarius Technologies' price-to-sales (or "P/S") ratio of 17x might still make it look like a strong sell right now compared to other companies in the Semiconductor industry in China, where around half of the companies have P/S ratios below 5.9x and even P/S below 2x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Primarius Technologies Has Been Performing

There hasn't been much to differentiate Primarius Technologies' and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Primarius Technologies will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Primarius Technologies would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. Pleasingly, revenue has also lifted 139% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 27% each year during the coming three years according to the three analysts following the company. With the industry predicted to deliver 29% growth each year, the company is positioned for a comparable revenue result.

With this information, we find it interesting that Primarius Technologies is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Primarius Technologies' shares may have suffered, but its P/S remains high. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Analysts are forecasting Primarius Technologies' revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Primarius Technologies with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.