Unfortunately for some shareholders, the Kangxi Communication Technologies (Shanghai) Co., Ltd. (SHSE:688653) share price has dived 31% in the last thirty days, prolonging recent pain. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

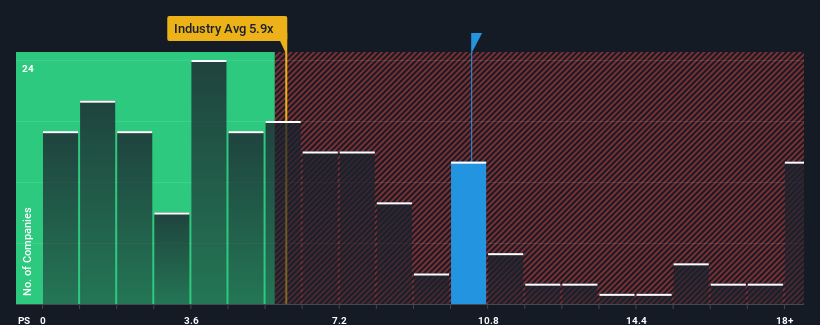

Although its price has dipped substantially, Kangxi Communication Technologies (Shanghai)'s price-to-sales (or "P/S") ratio of 10.4x might still make it look like a strong sell right now compared to other companies in the Semiconductor industry in China, where around half of the companies have P/S ratios below 5.9x and even P/S below 2x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Kangxi Communication Technologies (Shanghai)'s P/S Mean For Shareholders?

For instance, Kangxi Communication Technologies (Shanghai)'s receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Kangxi Communication Technologies (Shanghai), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Kangxi Communication Technologies (Shanghai)'s Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Kangxi Communication Technologies (Shanghai)'s is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.1%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 34% shows it's noticeably more attractive.

With this information, we can see why Kangxi Communication Technologies (Shanghai) is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

Kangxi Communication Technologies (Shanghai)'s shares may have suffered, but its P/S remains high. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that Kangxi Communication Technologies (Shanghai) can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Having said that, be aware Kangxi Communication Technologies (Shanghai) is showing 2 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Kangxi Communication Technologies (Shanghai), explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.