It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Liberty Energy (NYSE:LBRT). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Liberty Energy with the means to add long-term value to shareholders.

Liberty Energy's Improving Profits

Liberty Energy has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. To the delight of shareholders, Liberty Energy's EPS soared from US$2.17 to US$3.35, over the last year. That's a impressive gain of 55%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Liberty Energy shareholders is that EBIT margins have grown from 12% to 16% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Liberty Energy shareholders is that EBIT margins have grown from 12% to 16% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

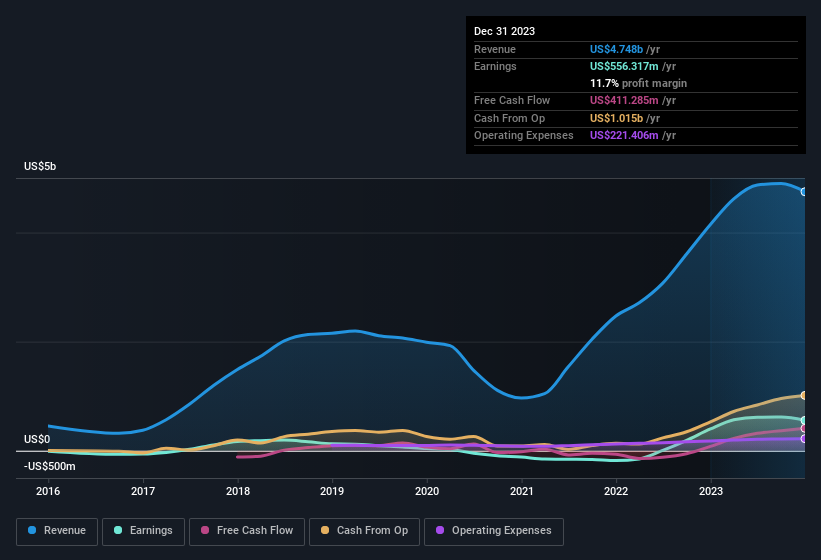

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

NYSE:LBRT Earnings and Revenue History April 18th 2024

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Liberty Energy?

Are Liberty Energy Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that Liberty Energy insiders have a significant amount of capital invested in the stock. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$124m. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to Liberty Energy, with market caps between US$2.0b and US$6.4b, is around US$6.6m.

The Liberty Energy CEO received US$5.6m in compensation for the year ending December 2023. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Liberty Energy Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Liberty Energy's strong EPS growth. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. The overarching message here is that Liberty Energy has underlying strengths that make it worth a look at. We should say that we've discovered 2 warning signs for Liberty Energy (1 shouldn't be ignored!) that you should be aware of before investing here.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

多くの投資家、特に未経験者は、損失を出している企業であっても良いストーリーを持っている企業の株式を購入することが一般的です。時には、これらのストーリーが投資家の考えを曇らせ、優れた企業の基本的なファンダメンタルズに基づく投資よりも感情に基づく投資をすることになります。損失を出している会社は、常に財務の持続可能性を確保するために時間との競争をしています。これらの企業への投資家は、彼らがすべき以上のリスクを負っているかもしれません。

このような高いリスクと高い報酬の考え方が合わない場合は、Liberty Energy (NYSE:LBRT)のような利益を上げ、成長している企業に興味を持つかもしれません。市場で公正に評価されているにしても、投資家たちは一致するでしょう。一貫した利益を上げることが、株主に長期的な価値を提供する手段となる」と。

リバティーエナジーの利益改善

過去3年間で、Liberty Energyの1株当たり利益は大幅に成長しました。それほどまでに、この3年間の成長率では、会社の将来性を公正に評価することはできなくなりました。そのため、ここでは、代わりに過去1年間の成長に注目することにします。株主たちを喜ばせるのは、過去1年間でLiberty EnergyのEPSがUS$2.17からUS$3.35に急上昇したことです。これは55%の驚異的な増加です。

売上高の成長と利益(稼働利益)マージンの慎重な検討は、最近の利益成長の持続可能性についての見通しを助けることができます。Liberty Energyの株主たちにとって最も耳に嬉しいのは、過去12か月間に稼働利益マージンが12%から16%に成長し、売上も上昇傾向にあるということです。この2つの条件が満たされるということは、私たちの考えでは成長の良い兆候です。

売上高の成長と利益(稼働利益)マージンの慎重な検討は、最近の利益成長の持続可能性についての見通しを助けることができます。Liberty Energyの株主たちにとって最も耳に嬉しいのは、過去12か月間に稼働利益マージンが12%から16%に成長し、売上も上昇傾向にあるということです。この2つの条件が満たされるということは、私たちの考えでは成長の良い兆候です。

以下のグラフは、会社の収益や利益の推移を示しています。より詳細な情報については、画像をクリックしてください。

米国NYSEのLBRTの利益と売上高の履歴(2024年4月18日)

今後のEPS見積もりを示すインタラクティブチャートを確認してみませんか?リバティーエナジーについてです。

株主とLiberty Energyのインサイダーたちは同じ船に乗っていますか?

インサイダーたちも株式を保有している場合、会社の株式を保有することは投資家にとって安心感を与えるはずです。実際、Liberty Energyのインサイダーたちは、現在US$124mもの価値があるかなりの資産を保有しています。保有者は、会社の指導者が株価の上昇や下落によって成功や失敗を共有することになるため、このレベルのインサイダーのコミットメントを非常に励みに感じるはずです。

インサイダーたちが会社に投資していることは良いことですが、報酬レベルは適切でしょうか?CEOの給与に基づくと、確かに適切であると考えられます。Liberty Energyの時価総額がUS$2.0bからUS$6.4bの間にある企業と同等の大きさを持つCEOのメディアン総報酬は、約US$6.6m程度です。年末までのLiberty EnergyのCEOの報酬は、US$5.6mでした。同等の規模の会社に比べて平均を下回っており、かなり合理的です。CEOの報酬は、企業を考慮する上で最も重要な側面ではありませんが、適切であれば、指導者が株主の利益に配慮していることを示す少しの自信を与えてくれます。一般的に、これは良いガバナンスの証明にもなります。

リバティーエナジーにウォッチリストに含める必要があるのでしょうか?

株価はEPSに従うという考え方を支持する場合、Liberty Energyの強いEPS成長についてさらに掘り下げるべきです。疑問がある場合は、インサイダーたちも株主と同じ船に乗っており、CEOの報酬も同じ規模の会社と比較してかなり控えめであるということを覚えておいてください。Liberty Energyには興味を持つ価値のある潜在的な強みがあるといえます。しかし、ここに投資する前に知っておく必要がある2つの警告があります(1つは無視できません)。

リバティーエナジーにウォッチリストに含めるべきかどうか?

利益が増え、インサイダーが株を購入していなくても良い株式を購入することができる可能性は常にあります。ただし、これらが重要なメトリックであると考える人々には、これらの特徴を持つ会社をチェックすることをお勧めします。最近のインサイダーの購入をバックアップした成長を示した企業のリストにアクセスできます。

この記事で言及されている内部取引は、関連する管轄区域の報告可能な取引を参照しています。

この記事に関するご意見、ご要望はこちらのメールアドレス(editorial-team(at)simplywallst.com)でも受け付けております。

このSimply Wall Stの記事は一般的なものです。私たちは中立的な方法論を用いて、歴史的データとアナリストの予測に基づく解説を行っており、私たちの記事は財布のアドバイスを意図しておりません。これはいかなる株式において購入または販売を推奨するものではなく、あなたの目的や財政状況を考慮に入れていません。私たちは、基本的なデータによるロングタームターゲティングの分析を提供することを目的としています。そのため、私たちの分析は、最新の株価に関する会社発表や定性的な材料については反映されていないかもしれないことに注意してください。Simply Wall Stは、言及されているどの株式にもポジションを持っていません。

売上高の成長と利益(稼働利益)マージンの慎重な検討は、最近の利益成長の持続可能性についての見通しを助けることができます。Liberty Energyの株主たちにとって最も耳に嬉しいのは、過去12か月間に稼働利益マージンが12%から16%に成長し、売上も上昇傾向にあるということです。この2つの条件が満たされるということは、私たちの考えでは成長の良い兆候です。

売上高の成長と利益(稼働利益)マージンの慎重な検討は、最近の利益成長の持続可能性についての見通しを助けることができます。Liberty Energyの株主たちにとって最も耳に嬉しいのは、過去12か月間に稼働利益マージンが12%から16%に成長し、売上も上昇傾向にあるということです。この2つの条件が満たされるということは、私たちの考えでは成長の良い兆候です。

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Liberty Energy shareholders is that EBIT margins have grown from 12% to 16% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Liberty Energy shareholders is that EBIT margins have grown from 12% to 16% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.