Hubei Chaozhuo Aviation Technology Co., Ltd. (SHSE:688237) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 56% share price decline.

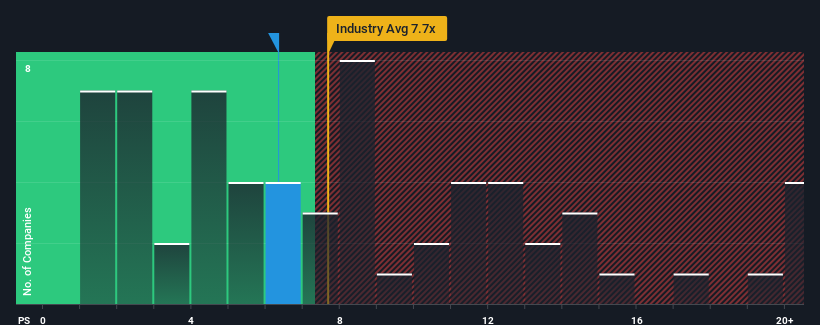

Even after such a large drop in price, it's still not a stretch to say that Hubei Chaozhuo Aviation Technology's price-to-sales (or "P/S") ratio of 6.3x right now seems quite "middle-of-the-road" compared to the Aerospace & Defense industry in China, where the median P/S ratio is around 7.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does Hubei Chaozhuo Aviation Technology's Recent Performance Look Like?

Hubei Chaozhuo Aviation Technology certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Hubei Chaozhuo Aviation Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Hubei Chaozhuo Aviation Technology's Revenue Growth Trending?

Hubei Chaozhuo Aviation Technology's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Hubei Chaozhuo Aviation Technology's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 93%. Pleasingly, revenue has also lifted 120% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 26%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Hubei Chaozhuo Aviation Technology's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Hubei Chaozhuo Aviation Technology's P/S

Following Hubei Chaozhuo Aviation Technology's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We didn't quite envision Hubei Chaozhuo Aviation Technology's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Hubei Chaozhuo Aviation Technology you should know about.

If these risks are making you reconsider your opinion on Hubei Chaozhuo Aviation Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.