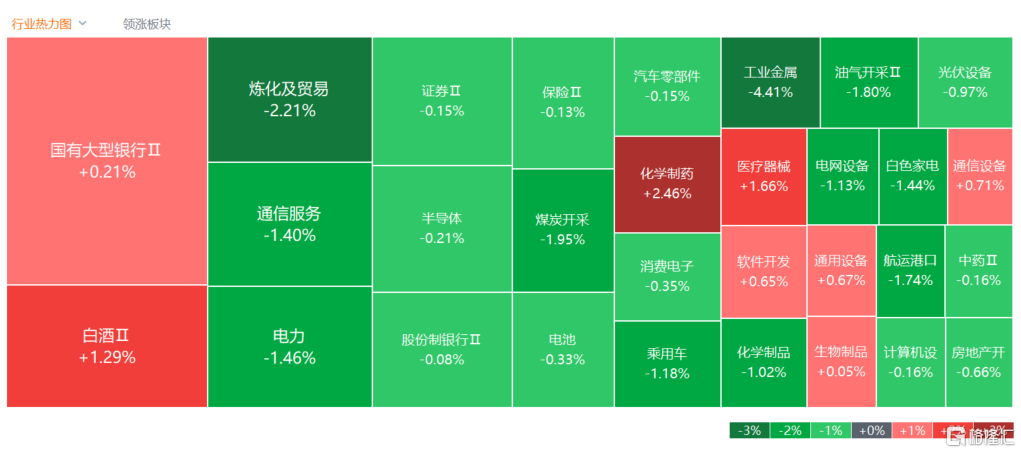

On April 23, the main A-share index fluctuated and weakened today. By the close, the Shanghai index fell 0.74% to 3021 points, recording 3 consecutive declines; the Shenzhen Stock Exchange Index fell 0.61% to record 4 consecutive declines; and the GEM index rose 0.15%. More than 3,200 shares rose, and full-day transactions of 775.3 billion yuan decreased by 46.7 billion yuan compared to yesterday.

On the market, the Ministry of Education announced the first batch of 18 typical examples of “artificial intelligence+higher education” application scenarios. The education sector surged, and Kaiyuan Education rose and stopped by 20cm; the military information technology sector strengthened, and many stocks such as Guangha Communications rose and stopped; the engineering consulting services sector rose, and many stocks such as construction research and design rose and stopped; the robot actuator sector rose, Fengli Intelligence rose and stopped; and sectors such as micromarket stocks, spatial computing, and new urbanization registered the highest gains.

Furthermore, risk aversion cooled down, and the precious metals and gold sectors fell, and Zhongrun Resources fell by more than 8%; coal stocks fell, and Orchid Science and Technology fell to a halt; the shipbuilding sector weakened, and China Shipbuilding Defense fell by more than 6%; and sectors such as phosphorous chemicals, automobile dismantling, and steel had the highest declines.

Let's take a look specifically:

The precious metals concept continued to recover. Zhongrun Resources fell by more than 8%, while Hunan Baiyin and Sichuan Gold fell by more than 5%. According to the news, the situation in the East has eased, and the price of gold has recovered for the second day in a row. Spot gold fell below the 2,300 mark in the intraday market today, the first time since April 8.

Coal stocks declined, Orchid Science and Technology and Shanxi Coking fell to a standstill, and Panjiang shares fell by more than 8%. According to the news, many coal companies' performance declined in the first quarter. Among them, the net profit of Orchid Science and Technology Innovation decreased by 82.55% year on year, and the net profit of Shanxi Coking decreased by 91.37% year on year. However, Dongwu Securities said that after the disclosure of the quarterly report at the end of April, the downside was released; in May, as coal prices strengthened, opportunities for sector investment and allocation came; considering entering the peak season of traditional thermal coal, coking coal prices will follow the rise in thermal coal prices, but thermal coal prices are more flexible.

The military information technology sector is strong, with Xingtu Xinke, Guangha Communications, and Aowei Communications rising and falling. The Dongwu Securities Research Report pointed out that they are optimistic about the military industry's reversal opportunities, the low-altitude economy and other new productivity directions will activate upstream support links. Orders for mid-term adjustments to various equipment lines will soon be implemented. The surrounding situation and environment continues to be tense. The military central enterprises focus on medium- to long-term market value management, and multiple factors are compounded to resonate. The industry is expected to usher in a continuous market of renewed growth rate and valuation repair. It is recommended to focus on two directions: (1) on the eve of global tension and the release of mid-level orders, focus on leading central enterprises with a long military aircraft industry chain and strong performance certainty; (2) the low-altitude economy is a major new investment direction that is expected to replicate satellite internet. Continued catalytic policies and high market attention are high, and it is a direction worth continuing to pay attention to throughout 2024.

Education stocks had the highest gains. Kaiyuan Education 20CM rose and stopped, Onli Education rose more than 8%, and Kevin Education rose more than 7%. According to the news, recently, the Ministry of Education issued a notice announcing the first batch of 18 typical cases of “artificial intelligence+higher education” application scenarios. SDIC Securities said that with marginal improvements in education industry policies and clear supply in the industry, education companies can expect to benefit from the release of industry demand and achieve a reversal in performance.

Sora concept stocks continued to pick up. Annuoqi rose more than 9%, as Sai Group rose more than 5%, and Wanxing Technology, Cape Cloud, and Zhongguang Tianze followed suit. According to the CITIC Securities Research Report, the Sora model is expected to accelerate the penetration rate of Wensheng video applications in various industries. According to its estimates, by 2025, the median potential market space for domestic Wensheng video applications in the short video field could reach 8 billion yuan.

Today, Northbound Capital had net sales of 3,016 billion yuan throughout the day, of which Shanghai Stock Connect had net purchases of 186 million yuan and Shenzhen Stock Connect had net sales of 3.201 billion yuan.

Looking ahead to the future market, the China Merchants Securities Research Report said,A-share profits have bottomed out and rebounded in the third quarter of 2023Looking at the fourth quarter of 2023 to 2024, as economic recovery continues to advance, under the influence of a low base, inventory, and profit cycle, it is expected that A-share earnings for the full year of 2024 will improve quarterly and reach a high level around the end of 2024.

The areas where the quarterly performance growth rate of listed companies is expected to improve or improve marginally are mainly expected to develop along the following main lines : (1) Export chain: white electricity, small household appliances, auto parts, marine equipment, general equipment, power grid equipment, etc.; (2) consumption/travel fields: such as hotels and restaurants, tourism and scenic spots, snack food, railway highways, logistics, etc.; (3) resource fields: industrial metals, precious metals, oil and gas extraction, etc.; (4) other semiconductor equipment, communication equipment, film and television, electricity, oil transportation and other industries.