Overseas markets, high-end and intelligence have become important labels for BYD this year

On the evening of April 29th, BYD announced the results for the first quarter of 2024.

In the context of a big price war, BYD's performance still achieved a profit growth rate exceeding the revenue growth rate in 24Q1.

Furthermore, since BYD's price reduction promotion in the first quarter was mainly driven by sales of low-end models in the Dynasty and Ocean series, bicycle revenue and profits inevitably declined. Whether it can return to the right track of growth in the future depends on whether high-end brands can account for a larger share of the sales structure.

In the first quarter of this year, BYD achieved revenue of 124.944 billion yuan, up 3.97% year on year and 30% month on month; net profit to mother was 4.57 billion yuan, up 10.62% year on year and down 47.3% month on month; net profit after deducting non-net profit was 3.75 billion yuan, up 5.24% year on year, down 59% month on month; gross margin increased 4 percentage points year on year, up 0.66 percentage points from month to month to 21.88% month on month.

1. Sales overtook production, but profitability was slightly affected

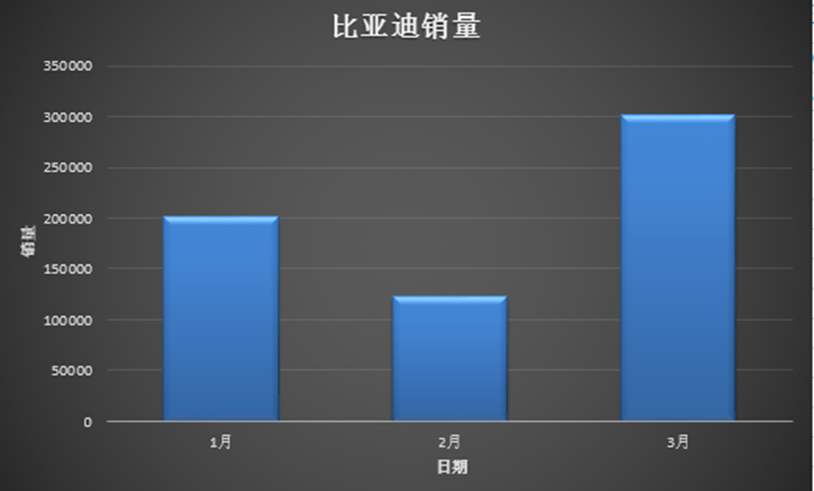

In the first quarter of this year, BYD's production and sales volume of new energy vehicles reached 612,000 units and 626,300 units respectively, up 8% and 13% year over year, surpassing production and reducing pressure on BYD's inventory.

It can be seen that BYD's price reduction promotion strategy did work, but it also had a slight impact on BYD's profitability. In the first quarter of this year, BYD's bicycle revenue and bicycle profit declined to varying degrees in the first quarter.

Among them, bicycle revenue was 141,000 yuan, a year-on-year decrease of 28,700 yuan, and a month-on-month decrease of 0.95 million yuan. However, the decline in bicycle profit was not significant. It was 0.63 million yuan, a year-on-year decrease of 0.04 million yuan, and a month-on-month decrease of 0.24 million yuan.

According to Wall Street Insights and Insight Research, the reasons are as follows:

First, BYD implemented a price reduction promotion campaign, which was mainly driven by sales of low-end models in the Dynasty and Ocean series. The overall revenue growth rate (3.97%) was far lower than the sales growth rate (13%), so bicycle prices declined somewhat.

Taking March, the first full month after the price cut, as an example, sales of the Dynasty and Ocean series reached 286,700 units, up 47% year on year and 151% month on month, far higher than the high-end brand Equation and Upward (54% and 44% month-on-month increase, respectively).

After a wave of rapid month-on-month growth in the fourth quarter of the past year, sales of BYD's high-end brands have stabilized. In the first quarter of this year, Tense, Fangchengbao, and Yangwang brands sold 31,000 units, 11,000 units, and 0.3,500 units respectively, with an overall share stable at around 7%.

Second, BYD's price reduction promotion targets mainly plug-in hybrid models that cost around 100,000 yuan, while for the same product, BYD's plug-in hybrid models are about 20,000 yuan cheaper than pure electric models, which further lowers the price of bicycles.

In the first quarter of this year, due to strong price reduction promotions, the sales volume and growth rate of BYD's plug-in hybrid models overtook pure electric ones. Among them, sales of pure electric models were 3010,000 units, up 13% year on year; sales of plug-in hybrid models were 324,300 units, up 15% year on year.

Third, the decline in BYD's bicycle profit was far lower than that of bicycle profits, mainly due to falling costs. The decline in the price of raw material lithium carbonate has reduced the cost pressure on BYD to a certain extent. In the first quarter of this year, BYD's operating costs decreased by 1.1 billion yuan year-on-year, and 44.2 billion yuan to 97.6 billion yuan month-on-month.

2. High-end and intelligent have become important labels this year, and expenses have begun to grow at a high rate

After BYD clearly accelerated the development of high-end brand models and investment in the field of intelligent driving, there was also a marked increase in R&D expenses this year.

BYD expects to launch 7 high-end brand models in 2024, including 3 Tension models, Equation Leopard 8 and 3, and the U7 and U9.

The launch of more high-priced models is expected to move the bicycle revenue center upward.

Furthermore, in order not to be left behind in the era of intelligent driving, BYD's intelligent driving system, the “Eye of Tenjin” advanced intelligent driving assistance system, still needs to be continuously upgraded to bring it closer to the first tier of Tesla and Huawei, and related R&D investment is also increasing.

In the first quarter of '24, BYD invested 10.61 billion yuan in R&D, an increase of 70.1% over the previous year.

3. Overseas markets are opening up at an accelerated pace, and the share of exports continues to rise

Strengthening exports of new energy vehicles has become a consensus among car companies, and BYD is clearly developing overseas markets faster.

By the end of the first quarter of this year, new energy models such as the YuanPLUS, ATTO3, Dolphin, and Song PLUS EVs launched by BYD had successfully entered more than 70 countries and regions on six continents, opening more than 250 overseas stores.

In terms of export volume growth, in the first quarter of this year, BYD's export volume reached 99,000 vehicles, surpassing Tesla to become the number one domestic NEV exporter for the first time.

The year-on-year growth rate of this export volume was as high as 153%, far higher than the 13% growth rate of domestic sales.

Overseas markets are expected to be the key to continued growth in BYD's sales and profits. BYD has confirmed that it will build plants in Thailand (150,000 vehicles, expected to be put into operation in 2024), Brazil (production capacity of 150,000 vehicles, expected to be put into operation in 2024), Uzbekistan (total production capacity of 300,000 vehicles, phase 1 has already been put into operation), Szeged, Hungary (expected to start production in 2025), and Mexico (production capacity 150,000 vehicles, site being selected).

In summary, accelerated exports, high-end and intelligence have become important labels for BYD this year, and are expected to be the key to BYD's continued growth in automobile sales and profits in the future.