Even though General Elevator Co., Ltd's (SZSE:300931) recent earnings release was robust, the market didn't seem to notice. Our analysis suggests that investors might be missing some promising details.

How Do Unusual Items Influence Profit?

For anyone who wants to understand General Elevator's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit was reduced by CN¥18m due to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. General Elevator took a rather significant hit from unusual items in the year to March 2024. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of General Elevator.

Our Take On General Elevator's Profit Performance

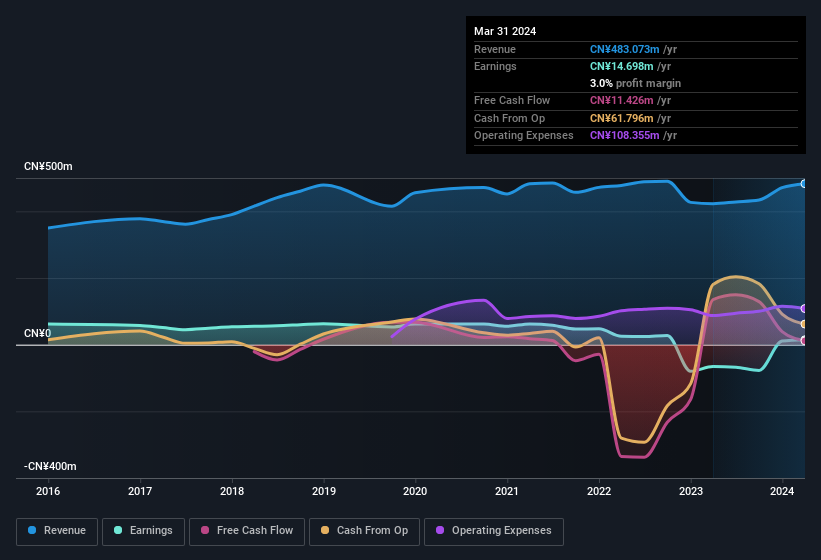

As we discussed above, we think the significant unusual expense will make General Elevator's statutory profit lower than it would otherwise have been. Based on this observation, we consider it possible that General Elevator's statutory profit actually understates its earnings potential! And it's also positive that the company showed enough improvement to book a profit this year, after losing money last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So while earnings quality is important, it's equally important to consider the risks facing General Elevator at this point in time. Our analysis shows 4 warning signs for General Elevator (3 shouldn't be ignored!) and we strongly recommend you look at them before investing.

As we discussed above, we think the significant unusual expense will make General Elevator's statutory profit lower than it would otherwise have been. Based on this observation, we consider it possible that General Elevator's statutory profit actually understates its earnings potential! And it's also positive that the company showed enough improvement to book a profit this year, after losing money last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So while earnings quality is important, it's equally important to consider the risks facing General Elevator at this point in time. Our analysis shows 4 warning signs for General Elevator (3 shouldn't be ignored!) and we strongly recommend you look at them before investing.

Today we've zoomed in on a single data point to better understand the nature of General Elevator's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.