Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Hygeia Healthcare Holdings Co., Limited (HKG:6078) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Hygeia Healthcare Holdings's Debt?

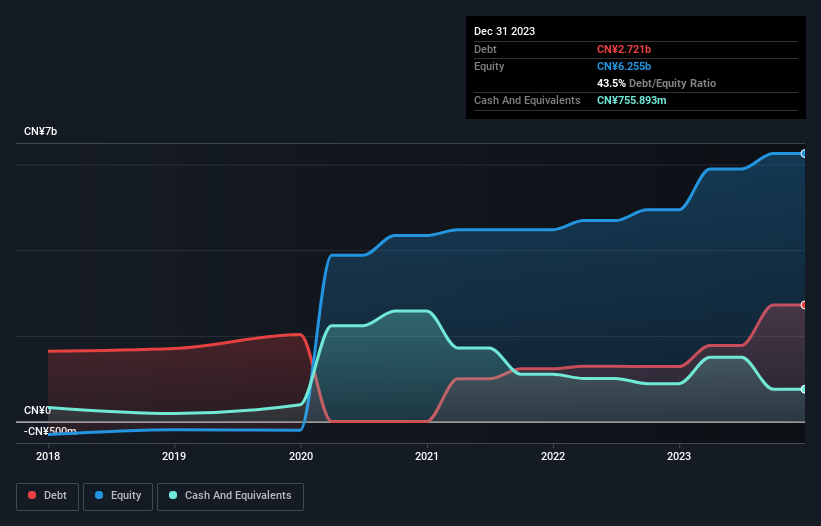

You can click the graphic below for the historical numbers, but it shows that as of December 2023 Hygeia Healthcare Holdings had CN¥2.72b of debt, an increase on CN¥1.28b, over one year. On the flip side, it has CN¥755.9m in cash leading to net debt of about CN¥1.97b.

A Look At Hygeia Healthcare Holdings' Liabilities

Zooming in on the latest balance sheet data, we can see that Hygeia Healthcare Holdings had liabilities of CN¥1.94b due within 12 months and liabilities of CN¥2.54b due beyond that. Offsetting this, it had CN¥755.9m in cash and CN¥912.3m in receivables that were due within 12 months. So it has liabilities totalling CN¥2.81b more than its cash and near-term receivables, combined.

Since publicly traded Hygeia Healthcare Holdings shares are worth a total of CN¥21.2b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Hygeia Healthcare Holdings's net debt to EBITDA ratio of about 1.9 suggests only moderate use of debt. And its commanding EBIT of 26.4 times its interest expense, implies the debt load is as light as a peacock feather. One way Hygeia Healthcare Holdings could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 18%, as it did over the last year. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Hygeia Healthcare Holdings's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Hygeia Healthcare Holdings recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

On our analysis Hygeia Healthcare Holdings's interest cover should signal that it won't have too much trouble with its debt. But the other factors we noted above weren't so encouraging. In particular, conversion of EBIT to free cash flow gives us cold feet. We would also note that Healthcare industry companies like Hygeia Healthcare Holdings commonly do use debt without problems. When we consider all the elements mentioned above, it seems to us that Hygeia Healthcare Holdings is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Hygeia Healthcare Holdings insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.