With its stock down 6.6% over the past three months, it is easy to disregard Heilongjiang Publishing & Media (SHSE:605577). However, stock prices are usually driven by a company's financial performance over the long term, which in this case looks quite promising. In this article, we decided to focus on Heilongjiang Publishing & Media's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Heilongjiang Publishing & Media is:

9.0% = CN¥340m ÷ CN¥3.8b (Based on the trailing twelve months to March 2024).

The 'return' is the amount earned after tax over the last twelve months. That means that for every CN¥1 worth of shareholders' equity, the company generated CN¥0.09 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Heilongjiang Publishing & Media's Earnings Growth And 9.0% ROE

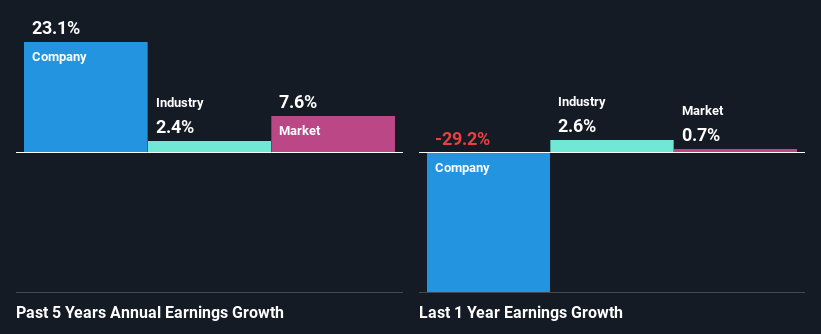

When you first look at it, Heilongjiang Publishing & Media's ROE doesn't look that attractive. Although a closer study shows that the company's ROE is higher than the industry average of 4.9% which we definitely can't overlook. Particularly, the substantial 23% net income growth seen by Heilongjiang Publishing & Media over the past five years is impressive . Bear in mind, the company does have a moderately low ROE. It is just that the industry ROE is lower. So, there might well be other reasons for the earnings to grow. For example, it is possible that the broader industry is going through a high growth phase, or that the company has a low payout ratio.

As a next step, we compared Heilongjiang Publishing & Media's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 2.4%.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. Is Heilongjiang Publishing & Media fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Heilongjiang Publishing & Media Using Its Retained Earnings Effectively?

Heilongjiang Publishing & Media has a really low three-year median payout ratio of 9.6%, meaning that it has the remaining 90% left over to reinvest into its business. So it seems like the management is reinvesting profits heavily to grow its business and this reflects in its earnings growth number.

While Heilongjiang Publishing & Media has seen growth in its earnings, it only recently started to pay a dividend. It is most likely that the company decided to impress new and existing shareholders with a dividend.

Summary

In total, we are pretty happy with Heilongjiang Publishing & Media's performance. In particular, it's great to see that the company has seen significant growth in its earnings backed by a respectable ROE and a high reinvestment rate. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Not to forget, share price outcomes are also dependent on the potential risks a company may face. So it is important for investors to be aware of the risks involved in the business. Our risks dashboard will have the 1 risk we have identified for Heilongjiang Publishing & Media.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.