Sanlux Co.,Ltd's (SZSE:002224) recent weak earnings report didn't cause a big stock movement. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

Examining Cashflow Against SanluxLtd's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

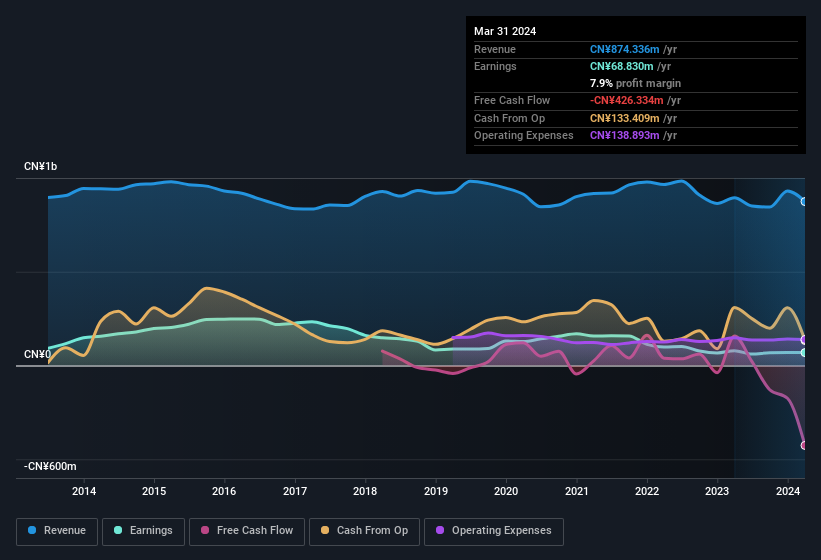

For the year to March 2024, SanluxLtd had an accrual ratio of 0.29. We can therefore deduce that its free cash flow fell well short of covering its statutory profit, suggesting we might want to think twice before putting a lot of weight on the latter. Even though it reported a profit of CN¥68.8m, a look at free cash flow indicates it actually burnt through CN¥426m in the last year. It's worth noting that SanluxLtd generated positive FCF of CN¥157m a year ago, so at least they've done it in the past. However, that's not the end of the story. We must also consider the impact of unusual items on statutory profit (and thus the accrual ratio), as well as note the ramifications of the company issuing new shares. The good news for shareholders is that SanluxLtd's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. As a result, some shareholders may be looking for stronger cash conversion in the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of SanluxLtd.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. In fact, SanluxLtd increased the number of shares on issue by 24% over the last twelve months by issuing new shares. That means its earnings are split among a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out SanluxLtd's historical EPS growth by clicking on this link.

A Look At The Impact Of SanluxLtd's Dilution On Its Earnings Per Share (EPS)

Unfortunately, SanluxLtd's profit is down 56% per year over three years. And even focusing only on the last twelve months, we see profit is down 13%. Sadly, earnings per share fell further, down a full 30% in that time. So you can see that the dilution has had a fairly significant impact on shareholders.

If SanluxLtd's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

The Impact Of Unusual Items On Profit

Unfortunately (in the short term) SanluxLtd saw its profit reduced by unusual items worth CN¥44m. If this was a non-cash charge, it would have made the accrual ratio better, if cashflow had stayed strong, so it's not great to see in combination with an uninspiring accrual ratio. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. In the twelve months to March 2024, SanluxLtd had a big unusual items expense. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

Our Take On SanluxLtd's Profit Performance

In conclusion, SanluxLtd's accrual ratio suggests that its statutory earnings are not backed by cash flow; but the fact unusual items actually weighed on profit may create upside if those unusual items to not recur. And the dilution means that per-share results are weaker than the bottom line might imply. Having considered these factors, we don't think SanluxLtd's statutory profits give an overly harsh view of the business. If you want to do dive deeper into SanluxLtd, you'd also look into what risks it is currently facing. Be aware that SanluxLtd is showing 4 warning signs in our investment analysis and 2 of those are a bit unpleasant...

Our examination of SanluxLtd has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.