暫時“愛玩不菜”

三年不分紅的方大炭素,公告要繼續購買巨額理財產品!

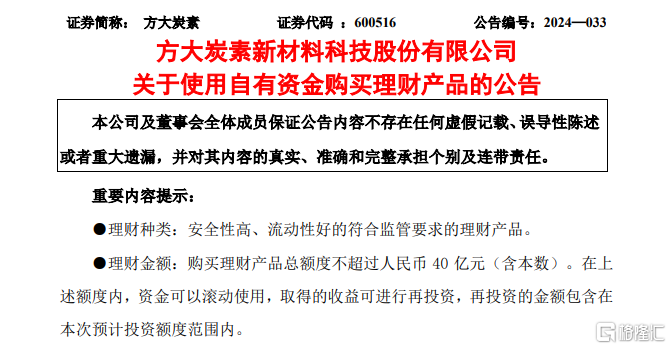

昨晚,方大炭素,宣佈了一項重大的財務決策:計劃使用不超過40億元人民幣購買理財產品。

這一決策在市場引起了廣泛關注,尤其是在公司在過去三年中並未進行現金分紅,同時賬上現金高達61.9億元的情況下。

“炒股”上癮

過往歷史來看,大手筆掏錢搞“投資”,方大炭素實際已是老手。

從2019年到2021年,公司宣佈計劃使用不超過60億元的自有閒置資金進行理財產品的購買。到了2023年,方大炭素進一步計劃使用不超過30億元用於理財,同時還有不超過20億元的資金被計劃用於證券投資。

雖然愛“玩”,但人家可不“菜”。

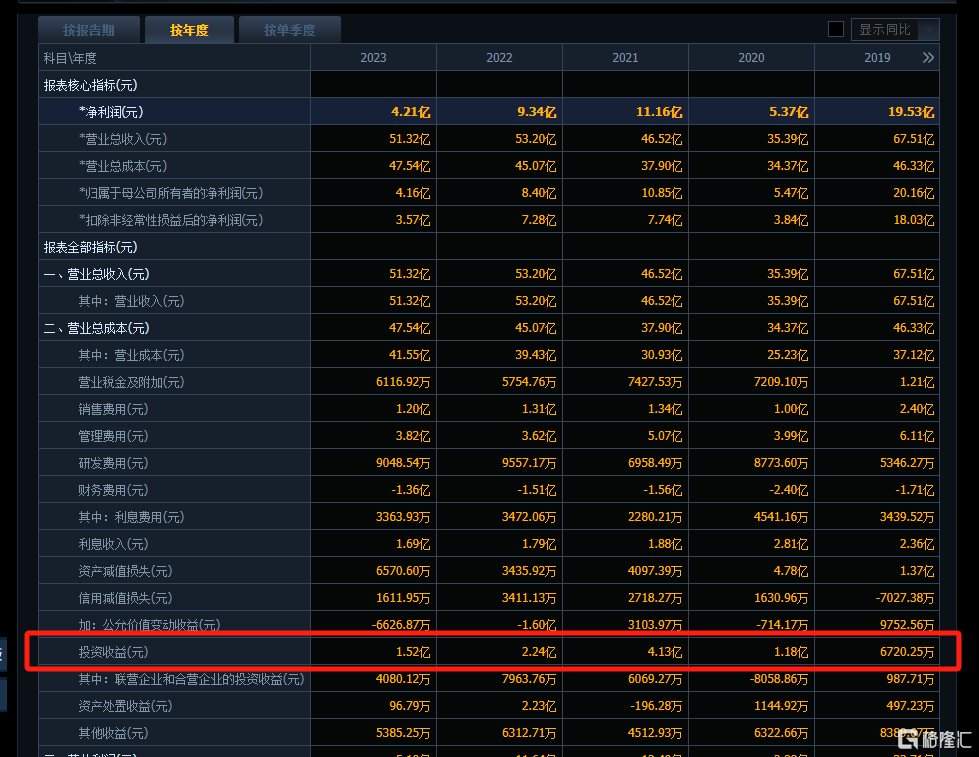

一扒成績,方大炭素確實在這塊還是有兩把刷子。根據公司2023年的年報,公司在該年度實現了1.52億元的投資收益,其中交易性金融資產在持有期間的投資收益爲1453萬元。

再往前看,2022年度實現2.24億元的投資收益,其中交易性金融資產在持有期間的投資收益爲458.4萬元;

2021年度實現4.13億元的投資收益,其中交易性金融資產在持有期間的投資收益爲281.48萬元。

截至2023年報期末,方大炭素持有的金融資產總額達到12.97億元,包括股票、私募基金和其他類別的資產,金額分別爲5.87億元、3.09億元和4.01億元。

公司的財務狀況也顯示出強勁的增長。2023年年報顯示,方大炭素持有的貨幣資金高達61.9億元,與前一年相比增長了96%,這一增長主要是由於公司收到的投資款增加所致。

儘管方大炭素在2021年至2023年期間並未提出現金分紅方案,但值得注意的是,公司在這三年中每年都實現了盈利。2023年,方大炭素利用現有的回購規則來豁免現金分紅。公司使用2.8億元的自有資金完成了股份回購,根據交易所的相關指引,這筆回購金額可以視作現金分紅,並納入年度現金分紅的相關比例計算。

通過這種方式,方大炭素在2023年度的現金分紅比例達到了67.27%,這是基於公司2023年度合併報表歸屬於上市公司股東的淨利潤(4.16億元)來計算的。自上市以來,方大炭素僅進行了7次現金分紅,累計分紅金額達59.87億元。

有炒股小夥伴“栽了”

事實上,方大系一衆公司都偏愛“炒股”。除方大炭素外,旗下諸如中興商業、海航控股也都有着一定的股權投資。

其中,方大特鋼才傳出“虧錢”消息。僅僅一個季度,方大特鋼買的理財產品便浮虧1.2億。

據悉,2022年11月,方大特鋼使用4.3億元閒置資金進行委託理財,委託中信信託管理。12月,該信託項目投資陽光保險H股股票7872.20萬股,每股5.83港元,總投資額4.59億港元。2023年9月,方大特鋼申請贖回1100萬份信託份額,回收資金803.11萬元,信託份額減少至4.19億份。

2024年一季度,陽光保險股票價格波動導致信託產品淨值下降,從2023年12月31日的3.14億元降至2024年3月31日的1.95億元,浮虧1.2億元,影響方大特鋼當季歸母淨利潤。儘管如此,方大特鋼仍看好陽光保險的業務增長和價值創造能力,不打算出售這部分資產。

方大特鋼還持有福日電子和阿特斯兩家A股公司股份,福日電子投資虧損69萬,阿特斯已於2023年出售。

和“親兄弟”方大炭素一樣,方大特鋼在投資上大手大腳,但近兩年分紅一樣摳摳搜搜。

2023年公司實現歸母淨利潤6.89億元,期末未分配利潤21.22億元,貨幣資金餘額60.45億元。在上交所的監管問詢後,方大特鋼於2024年3月29日宣佈分紅2.33億元。此前,方大特鋼自2003年上市以來累計實現淨利潤176.72億元,累計現金分紅125.90億元,2021年現金分紅比高達87.60%。