On the afternoon of May 14, Mingchuang Premium Group announced financial results for the first quarter of 2024.

The data shows that this is the Q1 where Mingchuang Premium's revenue reached a record high and stores expanded the fastest. The company went overseas smoothly. Overseas market revenue increased 53% year over year, exceeding the company's most optimistic expectations and setting a new record for the first quarter. Among them, overseas direct management grew by more than 80% for four consecutive quarters. Furthermore, the TOP TOY brand has been profitable for two consecutive quarters.

Financial data shows:

The company's total revenue in the first quarter increased 26% year on year to 3.72 billion yuan, up 26% year on year;

The gross profit margin was 43.4%, up 4.1 percentage points from 39.3% in the same period last year;

Profit for the period was 586 million yuan, up 24.4% year on year;

Adjusted net profit was $617 million, up 27.7% year over year.

Revenue increased 26.0% year over year, hitting a new high in the first quarter. The main reason was that the average number of stores at the group level increased 19.3% year over year and same-store sales increased by about 9%.

At the same time, thanks to the increase in the share of the direct sales market in overseas revenue and the optimization of TOP TOY's gross margin, the company's gross margin for the quarter was 43.4%, an increase of 4.1 percentage points over the previous year, once again reaching a record high.

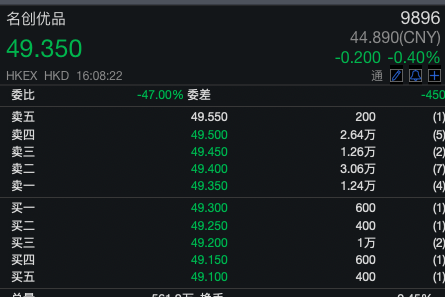

This was also the fastest quarter in the history of Mingchuang Premium to open stores. However, the capital market did not seem to buy Mingchuang's performance. By the close of the day, Mingchuang Premium's Hong Kong stock fell slightly by 0.40%.

As of press release, Mingchuang Premium US shares fell nearly 6% in the premarket.

Fastest quarter to open stores in history

Mr. Ye Guofu, founder, chairman and CEO of Mingchuang Premium said during the earnings conference call:

This past 3-month quarter was our fastest first quarter to open stores, which lays a solid foundation for achieving our goal of a net increase of 900 to 1,100 stores in 2024.

According to financial data, as of March 31, 2024, the number of Mingchuang Premium stores worldwide reached 6,630.

There were 217 net new stores this quarter, an increase of nearly 3 times compared with the net increase in the number of stores in the same period last year.

Among them, only the number of domestic stores surpassed 4,000 for the first time, reaching 4,034, with a net increase of 108 stores in the first quarter, nearly double the increase in the same period last year. This accounts for the increase in domestic revenue.

In the first quarter, revenue from mainland China increased 16.2% year on year to RMB 2,502 billion, contributing more than 60% of the first quarter's revenue. This was due to an 18.7% increase in the average number of stores and same-store sales of about 98% of the high base for the same period of the previous year.

Going overseas went smoothly, and overseas direct sales increased by more than 80% for four consecutive quarters

Overseas market revenue increased 52.6% year on year to 1,222 billion yuan, accounting for 32.8% of total revenue in the first quarter. Compared with a significant increase of 27.1% in the same period in 2023, the number of stores grew rapidly along with the performance of the same stores.

Among them, in terms of the number of stores, the number of overseas stores was 2,596, a net increase of 109 in the first quarter. Compared with the data of only 16 new stores in the same period last year, same-store sales also increased strongly by about 21%. At the same time, revenue from overseas direct sales accounted for about 58% of total overseas market revenue in the March quarter, which is also worth paying attention to.

Mr. Ye Guofu, founder, chairman and CEO of Mingchuang Premium, said:

Revenue from overseas markets increased 53% year over year, exceeding our most optimistic expectations and setting a new record for the first quarter. This is mainly due to a 92% year-on-year increase in revenue in our direct sales market, which is also the fourth consecutive quarter where the business grew by more than 80%.

Looking at the structure of overseas revenue, the US and Asia are the two major markets for Mingchuang Premium to go overseas. They account for nearly 3/4 of overseas GMV, and overall sales growth mainly depends on passenger traffic growth. Among them, in the US market, where consumption capacity is strong, local same-store sales increased 30% to 40% year-on-year in the first quarter of this year.

TOP TOY has been profitable for two consecutive quarters

In addition to being a premium brand, the TOP TOY brand continues to gain strength.

According to the data, as of March 31, the total number of TOP TOY stores reached 160, an increase of 44 year-on-year and an increase of 12 month-on-month. In terms of performance, TOP TOY's revenue for the quarter reached 214 million yuan, a year-on-year increase of 55.1%, a record high.

At the revenue level, TOP TOY achieved revenue of 138 million yuan in the first quarter, an increase of 55.1% year on year; the average number of stores increased by 32.2% year on year, and same-store sales increased by about 26% compared with the same period in 2023.

At the same time, the gross margin of the TOP TOY business increased by 8 percentage points year on year, and has achieved positive profits for two consecutive quarters. Mingchuang Premium management believes this is a key turning point in the brand's development.

Ye Guofu revealed during the earnings call, “We have stronger confidence in the rapid expansion of TOP TOY, so the target for opening stores this year was raised from 50 stores at the beginning of the year to 100. By the end of 2024, the number of TOP TOY stores is expected to expand to more than 250.”

Looking forward to the future, Ye Guofu said:

We have the necessary patience and perseverance, and are firmly committed to long-term principles, taking every step carefully and diligently to achieve our five-year development plan and maintain a compound annual revenue growth rate of no less than 20%.

第一季度公司总营收同比增长26%至37.2亿元,同比增长26%;

第一季度公司总营收同比增长26%至37.2亿元,同比增长26%;