[Focus on hot topics]

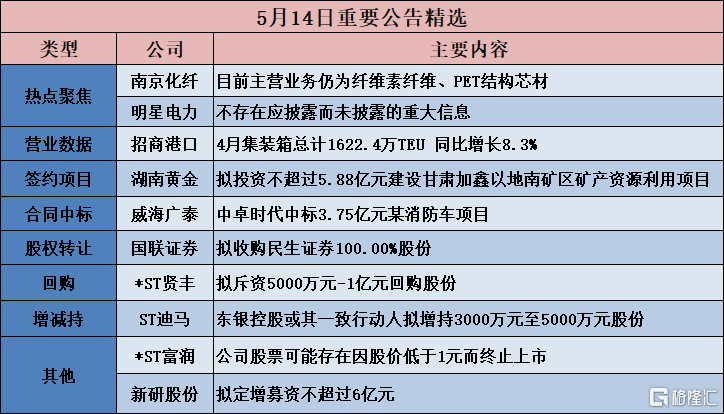

Nanjing Chemical Fiber (600889.SH): Currently, the main business is still cellulose fiber and PET structural core materials

Nanjing Chemical Fiber (600889.SH) announced a stock trading risk warning notice. Currently, the company's main business is still cellulose fiber and PET structural core materials. The company's production and operation conditions are normal, and there have been no major changes.

3-in-1 Star Electric Power (600101.SH): There is no material information that should be disclosed but not disclosed

Star Electric Power (600101.SH) announced a stock trading risk warning notice. The closing price of the company's stock rose and stopped for three consecutive trading days on May 10, May 13, and May 14, 2024. Stock prices have risen a lot recently, and there may be a risk of falling after a large short-term increase. The securities regulatory commission industry category to which the company belongs is “electricity, heat, gas and water production and supply”. According to data published on the official website of China Securities Index Co., Ltd., as of May 14, 2024, the industry had a static price-earnings ratio of 18.67, a rolling price-earnings ratio of 17.69, and a net price-earnings ratio of 1.63. Star Electric has a static price-earnings ratio of 28.76, a rolling price-earnings ratio of 26.98, and a net price-earnings ratio of 1.78, all higher than the industry average. As of the disclosure date of this announcement, there have been no major changes in the company's main business, production and operation situation, market environment, and industry policies compared with the information disclosed earlier, and there is no other significant information involving the company that should have been disclosed but not disclosed.

[Investment projects]

Hunan Gold (002155.SZ): Gansu Jiaxin plans to invest no more than 588 million yuan to build a mineral resource utilization project in the mining area south of Jiaxin, Gansu

Hunan Gold (002155.SZ) announced that in order to meet the development needs of its holding subsidiary Gansu Jiaxin Mining Co., Ltd. (hereinafter referred to as Gansu Jiaxin), further enhance the production scale of the company's gold products and enhance the company's core competitiveness, Gansu Jiaxin plans to invest no more than 588 million yuan to build a mineral resource utilization project in the mining area south of Jiaxin, Gansu.

Shengyuan Environmental Protection (300867.SZ): The wholly-owned subsidiary plans to invest 1,166 billion yuan to build chemical (food) raw materials and food, pharmaceutical and health industry projects

Shengyuan Environmental Protection (300867.SZ) announced that the company held the 3rd meeting of the 9th board of directors in 2024 on May 14, 2024 to review and pass the “Proposal on Wholly-owned Subsidiaries to Invest in the Construction of Chemical (Food) Ingredients and Food, Pharmaceutical and Health Industry Projects”, and agreed that the following wholly-owned subsidiaries will separately invest and build chemical (food) raw materials and food and pharmaceutical health industry projects.

Quanzhou Shengyuan Biotechnology Engineering Co., Ltd., a wholly-owned subsidiary of the company, plans to invest in the construction of a chemical (food) raw material project in the Petrochemical Industrial Park in Quangang District, Quanzhou City, Fujian Province, with an initial investment of RMB 749 million to first build a project with an annual output of 40,000 tons of taurine to carry out R&D, production and sales of taurine and related products, a chemical (food) ingredient. The project has basically completed preliminary preparations, and the project is currently undergoing procedures such as safety pre-assessment and construction permits for the main project. Quanzhou Shengyuan Kangjian Pharmaceutical Co., Ltd., a wholly-owned subsidiary of the company, plans to build a production line for taurine applications in the fields of food, pharmaceuticals, health products, pet food and feed in Qianhuang Town, Quangang District, Quanzhou City, Fujian Province. The investment amount of the project is about 397 million yuan. The total investment in the proposed construction project and early production project is RMB 1,166 billion. The funding source is the company's own capital.

[Contract won the bid]

Haibo Heavy Industries (300517.SZ): Signed major daily operating contracts totaling RMB 897.12,400

Haibo Heavy Industries (300517.SZ) announced that recently, Haibo Heavy Engineering Technology Co., Ltd. (hereinafter referred to as “Company”, “Party B”) and Poly Growth Engineering Co., Ltd. (hereinafter referred to as “Party A”) signed the “Contract for Manufacturing, Transportation and Installation of Steel Box Girders and Laminated Beams at the North Bank Construction Site of Section C of Zhongshan East Ring Road”, with a total contract amount of 897.12,400 yuan.

Jianghe Group (601886.SH): won the bid for the 289 million yuan curtain wall subcontract project

Jianghe Group (601886.SH) announced that Shanghai Jianghe Façade System Engineering Co., Ltd., a wholly-owned subsidiary of the company, recently won the bid for the curtain wall subcontract project for the C1c-01 plot of Zhangjiabang Wedge-shaped Greenland in Pudong New Area, Shanghai. The total bid amount was RMB 289 million, accounting for about 1.38% of the company's 2023 operating revenue. The project is located in Pudong New Area, Shanghai. The curtain wall area is about 114,500 square meters. The total construction period is estimated to be 457 days. After completion, it will become another important commercial office building in Pudong New Area.

Weihai Guangtai (002111.SZ): Zhongzhuo Times won a bid of 375 million yuan for a fire engine project

Weihai Guangtai (002111.SZ) announced that recently, Weihai Guangtai Airport Equipment Co., Ltd. learned that its wholly-owned subsidiary Beijing Zhongzhuo Times Fire Fighting Equipment Technology Co., Ltd. (“Zhongzhuo Era”) won the bid for a fire engine project and obtained a notice of winning the bid. The winning bid amount was 375 million yuan. The specific amount and circumstances will be promptly disclosed after the company signs the contract.

Longquan Co., Ltd. (002671.SZ): Won the bid of 94.2994 million yuan to purchase the second bid for the Zhangwei South Canal to Machihe Camera Flooding Project (Phase I) in Xiajin County

Longquan Co., Ltd. (002671.SZ) announced that on May 14, 2024, Shandong Longquan Pipe Industry Co., Ltd. received the “Notice of Winning the Tender” jointly issued by the tenderer, the Xiajin County Water Resources Development Center and the bidding agency, and determined that the company was the winning bidder for the “Purchase of the Second Bidding Project for the Zhangwei South Canal to the Mazihe River Camera (Phase 1)”. The winning bid price was RMB 94.294 million (tax included).

[[Share acquisition]

Shanghai Electric (601727.SH): Plans to transfer 95.5585% of Shanghai Jiyou's shares to the holding subsidiary Shanghai Electromechanical

Shanghai Electric (601727.SH) announced that the company and Shanghai Electric Hong Kong Co., Ltd., a wholly-owned subsidiary of the company, transferred 95.5585% of the total shares of the company's holding subsidiary Shanghai Jiyou Mingyu Machinery Technology Co., Ltd. (“Shanghai Jiyou”) to the company's holding subsidiary, Shanghai Jiyou Mingyu Machinery Technology Co., Ltd. (“Shanghai Jiyou”), based on the valuation value of 100% of Shanghai Jiyou's shares of RMB 5318.40 million as the evaluation reference date. 508,21833 million yuan.

NORD Co., Ltd. (600110.SH): Plans to purchase 37.5% of Hubei Nord Lithium

NORD Co., Ltd. (600110.SH) announced that it plans to purchase 37.50% of Hubei Nord Lithium Battery held by Hubei Nord Industrial Investment Partnership (limited partnership) and Hubei Changjiang Nord Industrial Investment Management Partnership (limited partnership) by issuing shares. The consideration for this transaction was paid by issuing shares. Since the valuation and pricing of the subject matter of this transaction have not yet been finalized, the specific plan, transaction price, share transaction arrangements, etc. in this transaction have not yet been determined. The details will be signed after the audit and evaluation work of the target company is completed, a supplementary agreement will be signed after the transaction parties agree, and disclosed in the restructuring report.

Shanghai Electromechanical (600835.SH): Proposed to acquire 100% of Shanghai Jiyou's shares

Shanghai Electromechanical (600835.SH) announced that it intends to acquire 100% of the shares of Shanghai Jiyou Mingyu Machinery Technology Co., Ltd. (“Shanghai Jiyou”) (“Shanghai Jiyou”), which is jointly owned by Shanghai Electric Group Co., Ltd. (“Shanghai Electric”), and Shanghai Electric Group Hong Kong Co., Ltd. (“Electric Group Hong Kong”) in cash. The assessed value of 100% of Shanghai Jiyou's shares is RMB 5318.40 million. Ultimately, the valuation value confirmed by the State-owned Assets Administration Department shall prevail.

Guolian Securities (601456.SH): Proposed to acquire 100.00% of Minsheng Securities

Guolian Securities (601456.SH) announced that the company plans to purchase 100.00% of the total shares of Minsheng Securities held by 46 counterparties, including the League of Nations Group and Fengquanyu, and raise supporting capital by issuing A-shares. As of the date of signing the summary of this plan, the audit and evaluation work of the target company has not been completed, and the target asset evaluation results and transaction price have not yet been determined. The total amount of supporting capital raised this time did not exceed RMB 2 billion (including capital), and the number of A-shares issued did not exceed 250 million shares (including capital). Ultimately, the upper limit was the amount of capital raised and the number of shares issued after review and approval by the Shanghai Stock Exchange and a registration decision made by the China Securities Regulatory Commission. After deducting intermediary fees and transaction taxes, the supporting funds raised in this transaction are intended to be used to develop the Minsheng Securities business.

[Business data]

China Merchants Port (001872.SZ): The total number of containers in April was 16.224 million TEU, up 8.3% year-on-year

China Merchants Port (001872.SZ) released business volume data for April 2024. The total number of containers in April 2024 was 16.224 million TEU, up 8.3% year on year; the total volume of bulk goods was 106.938 million tons, up 0.3% year on year.

[Repurchase]

ST Securities (002197.SZ): Plans to spend 20 million yuan to 40 million yuan to buy back the company's shares

ST Securities (002197.SZ) announced that the company plans to use its own funds to repurchase the company's shares through centralized bidding transactions to implement equity incentives or employee stock ownership plans. The repurchase amount is not less than RMB 20 million and not more than RMB 40 million (both including the principal amount); the repurchase price is not higher than RMB 12 per share (including the number of shares). According to the maximum repurchase price of RMB 12 per share, it is estimated that the number of shares that can be repurchased is approximately 1,666,667 shares to 3,333,333 shares, accounting for 0.27% to 0.54% of the current total share capital of the company. The specific number of shares to be repurchased is based on the actual number of shares at the end of the repurchase period. The implementation period is within 12 months from the date the company's board of directors reviewed and approved the share repurchase plan.

*ST Xianfeng (002141.SZ): Plans to spend 50 million yuan to repurchase shares

*ST Xianfeng (002141.SZ) announced that the company plans to spend 50 million yuan to repurchase shares, with a repurchase price of no more than RMB 2.20 per share (inclusive).

[Increase or decrease holdings]

Honghua Mathematics (688789.SH): Xinhu Zhinao plans to reduce its holdings by no more than 1.90%

Honghua Mathematics (688789.SH) announced that Zhejiang Xinhu Zhinao Investment Management Partnership (Limited Partnership) (“Xinhu Zhinao”), the company's shareholder plans to reduce its total holdings of the company's shares by no more than 2.288 million shares through bulk transactions within 3 months after 15 trading days from the date of disclosure of the announcement, to no more than 1.90% of the total number of shares of the company.

ST Dima (600565.SH): Bank of China Holdings or its co-actors plan to increase their shares by 30 million yuan to 50 million yuan

ST Dima (600565.SH) announced that on May 14, 2024, the company received a notice from the controlling shareholder Chongqing Dongyin Holding Group Co., Ltd. (hereinafter referred to as “Dongyin Holdings”) and its co-actor, Chongqing Dongyuan Dima Business Information Consulting Co., Ltd. (hereinafter referred to as “Dongyuan Dima Business”). Since the company's current stock closing price is less than 1 yuan, if the company's stock closing price falls below RMB 1 for 20 consecutive trading days, the listing and trading of the company's shares may be terminated by the Shanghai Stock Exchange. In order to protect the interests of investors and enhance investor confidence, Bank of China Holdings or its co-actors plan to increase their holdings of the Company's shares through the Shanghai Stock Exchange centralized bidding system within 6 months from May 15, 2024. The proposed increase in holdings will not be less than RMB 30 million (inclusive), and no more than RMB 50 million (inclusive). The increase price will not be higher than RMB 1.10 per share.

Dongpeng Holdings (003012.SZ): SCC Holdco B and Shanghai Zhelde plan to reduce their total holdings by no more than 3%

Dongpeng Holdings (003012.SZ) announced that SCC Growth I Holdco B, Ltd. and Beijing Hongshan Kunde Investment Management Center (limited partnership), a shareholder holding 33,933,743 shares and 35,292,367 shares of the company's shares (accounting for 2.9330% and 3.0504% of the company's total share capital excluding repurchase accounts, respectively) and Beijing Hongshan Kunde Investment Management Center (limited partnership) - Shanghai Zhelde Investment Center (limited partnership) plan to reduce the company's holdings by no more than through centralized bidding transactions, bulk transactions, and agreement transfers, etc. The company excludes 3% of the total share capital of the number of shares held in the special securities account for repurchase (the amount reduced by no more than 34,709,434 shares). Among them, the number of company shares reduced through centralized bidding transactions within any 90 consecutive days does not exceed 1% of the total number of company shares (i.e. 11,569,811 shares); the number of company shares reduced through bulk transactions within any 90 consecutive days does not exceed 2% of the total number of company shares (i.e. 23,139,623 shares). The holdings reduction period is 3 months after 15 trading days from the date of the announcement of this holdings reduction plan (i.e. from June 6, 2024 to September 5, 2024).

[Other]

*ST Furun (600070.SH): The listing of the company's shares may be terminated because the stock price is less than 1 yuan

*ST Furun (600070.SH) announced that, according to the provisions of section 9.2.1 (1) (a) of the “Stock Listing Rules”, listed companies that only issue A-shares on the Shanghai Stock Exchange, if the daily closing price of shares falls below 1 yuan for 20 consecutive trading days, the company's shares may be terminated by the Shanghai Stock Exchange. The closing price of the company's stock on May 14, 2024 was 0.99 yuan/share, lower than RMB 1 for the first time. There is a risk that the listing of the company's stock may be terminated because the stock price is below face value.

Xinyan Co., Ltd. (300159.SZ): Proposed capital increase of no more than 600 million yuan

Xinyan Co., Ltd. (300159.SZ) announced that it plans to raise total capital of no more than $60 million by issuing shares to specific targets. After deducting issuance fees, it is planned to use all of them to repay bank loans and supplement working capital. The shares issued to specific targets are Ningbo Huakong Qianjia Enterprise Management Consulting Co., Ltd. (“Ningbo Huakong”) and Jiaxing Huakong Tenghui Equity Investment Partnership (Limited Partnership) (“Jiaxing Huakong”), enterprises controlled by the actual controller of Ningbo Huakong Issuer Zhang Yang, and controlling shareholders of Jiaxing Huakong Issuer. Ningbo Huakong and Jiaxing Huakong plan to subscribe in cash for all shares issued by the company to specific targets. Ningbo Huakong and Jiaxing Huakong have both signed “Share Subscription Agreements with Effective Conditions” with the company. The issuance of shares to a specific target constituted a related transaction.