In an environment where the external market is still full of uncertainty, the disclosure of the 2023 report and 2024 quarterly report related to A-shares has come to an end. Looking back at 2023, companies related to the heparin industry faced quite a few challenges under stress tests in the face of declining pig cycles.

However, at the beginning of 2024, along with the gradual stabilization of the bottom of pig prices, some leading companies have improved significantly and shown strong resilience. Among them, Hapley, a leading company in the heparin industry, also handed over a report in the first quarter of 2024 with a 133% year-on-year increase in net profit, outperforming the industry's performance during the same period.

On the day after the release of the first quarterly report, the capital market voted with their feet, and Hypry's A shares jumped high. The increase on the same day reached 9.98%. Hong Kong stocks once again hit a new high of HK$3.63 since this year. So, what key information was revealed behind this report card?

Steady operation, net profit to mother increased by 133%

First, judging from the overall financial situation, compared to the performance of peers, Hapry was able to withstand pressure. The company's revenue increased steadily, and the profit side rebounded, and the performance was impressive.

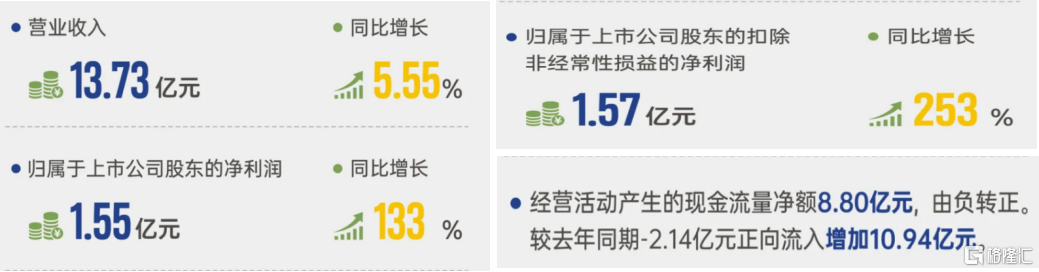

From the revenue side, in the first quarter of 2024, the company continued to operate steadily.Achieved sales revenue of RMB 1,373 billion, an increase of 5.55% over the previous year.

From the expenditure side, the company's three-fee expenses have been reduced, and the cost control performance is good.In the first quarter of 2024, the company's sales expenses, management expenses, and financial expenses decreased by 45.34%, 19.87%, and 22.20%, respectively.

From the profit side, the company has significantly reduced costs and increased efficiency, and profitabilitySome improvements. In the first quarter of 2024, the company's gross profit was 474 million yuan, up 4.25% year on year; net profit to mother was 155 million yuan, up 133% year on year; net profit after deducting non-return to mother was 157 million yuan, up 253% year on year.

Furthermore, the company's operating conditions are good, and the cash flow situation has improved significantly.In the first quarter of 2024, net cash flow from the company's operating activities was 880 million yuan, changing from negative to positive, an increase of 1,094 million yuan over the same period last year.

Chart 1: Highpree's financial data for the first quarter

Data source: Company data, compiled by Gelonghui

Remarkable restoration of the troika

Second, looking at the company's main business segments, the company's main business covers the entire heparin industry chain, biomacromolecule CDMO, and the three major sectors of innovative drugs.Q1 2024The entire heparin industry chain continues to expand into new markets, and the growth of new businesses is prominent.

Among them, the factors that disrupted the heparin API business were gradually fixed.The heparin API business sales increased year-on-year, and is full of resilience. As the world's largest supplier of heparin APIs, Hapley's impact on crude product prices due to upstream swine fever and swine cycles is gradually easing, terminal channel inventory removal is coming to an end, and the market is gradually picking up. Donghai Securities pointed out that the price of heparin APIs is already at the bottom of the cycle. As the relationship between supply and demand continues to improve, it is expected that 2024 will gradually begin a new heparin price upward cycle. As a leading company in the industry, Hapley is expected to continue to benefit.

In the heparin formulation business, the company's domestic and overseas marketsPositive layout, strong performance. Heparin is commonly used as an anticoagulant in clinical practice. As a commonly used low-molecular heparin preparation, enoxaparin preparations have better pharmacological activity and are the “gold standard” for treating diseases such as venous thromboembolism. They are expected to gradually become the mainstream variety in the market, and there is a lot of potential.

It is worth mentioning that in April 2024, Hypridinol heparin sodium injections were successively approved by New Zealand and Thailand, followed by four new product specifications that were successfully approved by the Singapore Health Sciences Authority (HSA) in May. This series of approvals not only highlights the excellent quality of the product, but also indicates that Hypridinol heparin sodium injections have been approved and marketed in more than 40 countries and regions around the world. Looking forward to the future, the company will continue to focus on breaking through the European and American markets, and accelerate market expansion in Asia, South America and other regions to open up a wider global market space.

In the CDMO business, the companyBusiness continued to recover, and revenue increased significantly year over year.CDMO is an important part of the pharmaceutical company's industrial chain, and global demand for biopharmaceutical CDMOs is strong. Hyperlink has entered the CDMO field through two wholly-owned subsidiaries, Saiwan Biotech and SPL. In the first quarter of 2024, the company continued its recovery in the fourth quarter of 2023, continued to strengthen cooperation with existing customers, actively expand new customers, optimize production capacity layout, and maximize the value of CDMO projects for customers.

Summarize

According to WIND data, pig prices have been running low since 2023 after experiencing a round of swine cycle fluctuations.

CICC Securities pointed out that starting in the second quarter of 2024, pig prices are expected to enter an upward channel. When entering a new cycle era, attention should be paid to investment opportunities at an inflection point.

Judging from the data already disclosed, Hapley is probably among them.

In the face of cyclical fluctuations in the global heparin industry, Hapley has shown strong resilience in a quarterly report. The revenue side operates steadily, the cost side has good cost control, the profit side has also shown growth elasticity that exceeds that of its peers, and the cash flow from operating activities continues to improve. The business side behind it also depicts a good growth curve. The marginal restoration is remarkable, and it is worthy of long-term attention and anticipation.