Deep-pocketed investors have adopted a bearish approach towards Airbnb (NASDAQ:ABNB), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ABNB usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for Airbnb. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 37% leaning bullish and 50% bearish. Among these notable options, 2 are puts, totaling $92,926, and 6 are calls, amounting to $571,408.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $145.0 to $165.0 for Airbnb during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $145.0 to $165.0 for Airbnb during the past quarter.

Analyzing Volume & Open Interest

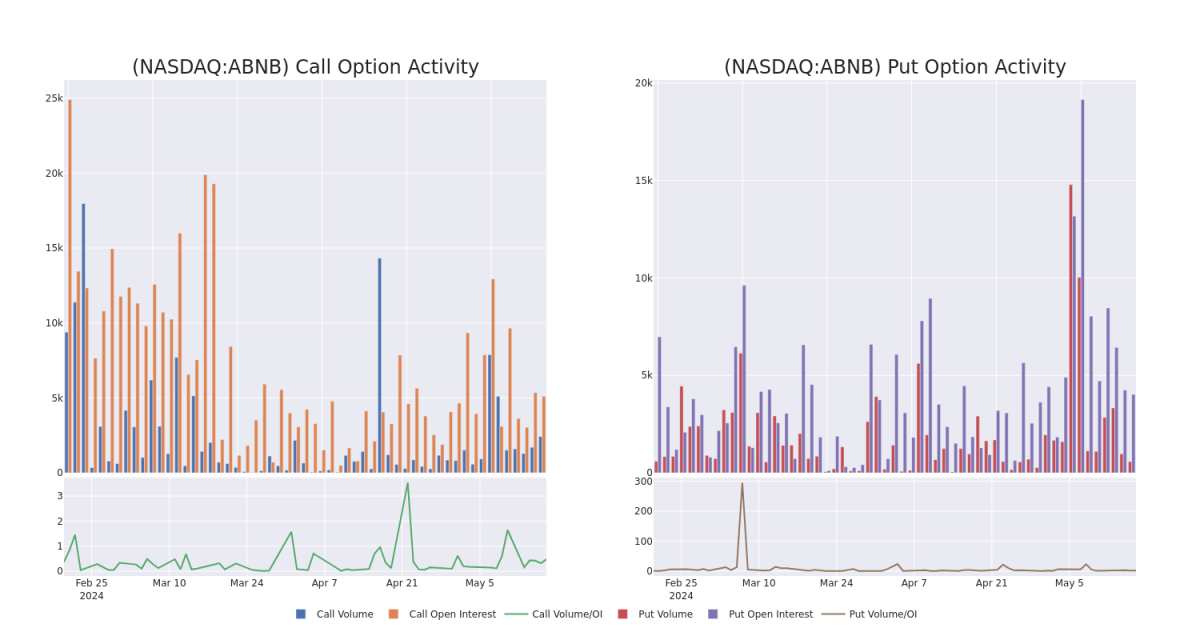

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Airbnb's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Airbnb's whale activity within a strike price range from $145.0 to $165.0 in the last 30 days.

Airbnb Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABNB | CALL | TRADE | BULLISH | 07/19/24 | $5.9 | $5.75 | $5.92 | $150.00 | $355.2K | 1.4K | 613 |

| ABNB | CALL | SWEEP | NEUTRAL | 01/17/25 | $14.85 | $14.65 | $14.75 | $155.00 | $67.8K | 967 | 46 |

| ABNB | PUT | TRADE | BEARISH | 06/21/24 | $4.0 | $3.95 | $4.0 | $145.00 | $67.6K | 3.9K | 477 |

| ABNB | CALL | TRADE | BEARISH | 07/19/24 | $1.75 | $1.7 | $1.7 | $165.00 | $42.6K | 2.4K | 257 |

| ABNB | CALL | TRADE | BULLISH | 07/19/24 | $1.71 | $1.7 | $1.71 | $165.00 | $42.4K | 2.4K | 505 |

About Airbnb

Started in 2008, Airbnb is the world's largest online alternative accommodation travel agency, also offering booking services for boutique hotels and experiences. Airbnb's platform offered 7.7 million active accommodation listings as of Dec. 31, 2023. Listings from the company's over 5 million hosts are spread over almost every country in the world. In 2023, 50% of revenue was from the North American region. Transaction fees for online bookings account for all its revenue.

Following our analysis of the options activities associated with Airbnb, we pivot to a closer look at the company's own performance.

Current Position of Airbnb

- Currently trading with a volume of 2,164,261, the ABNB's price is down by -0.94%, now at $145.81.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 76 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.