Financial giants have made a conspicuous bearish move on Vistra. Our analysis of options history for Vistra (NYSE:VST) revealed 16 unusual trades.

Delving into the details, we found 12% of traders were bullish, while 43% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $241,195, and 11 were calls, valued at $593,409.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $40.0 to $115.0 for Vistra during the past quarter.

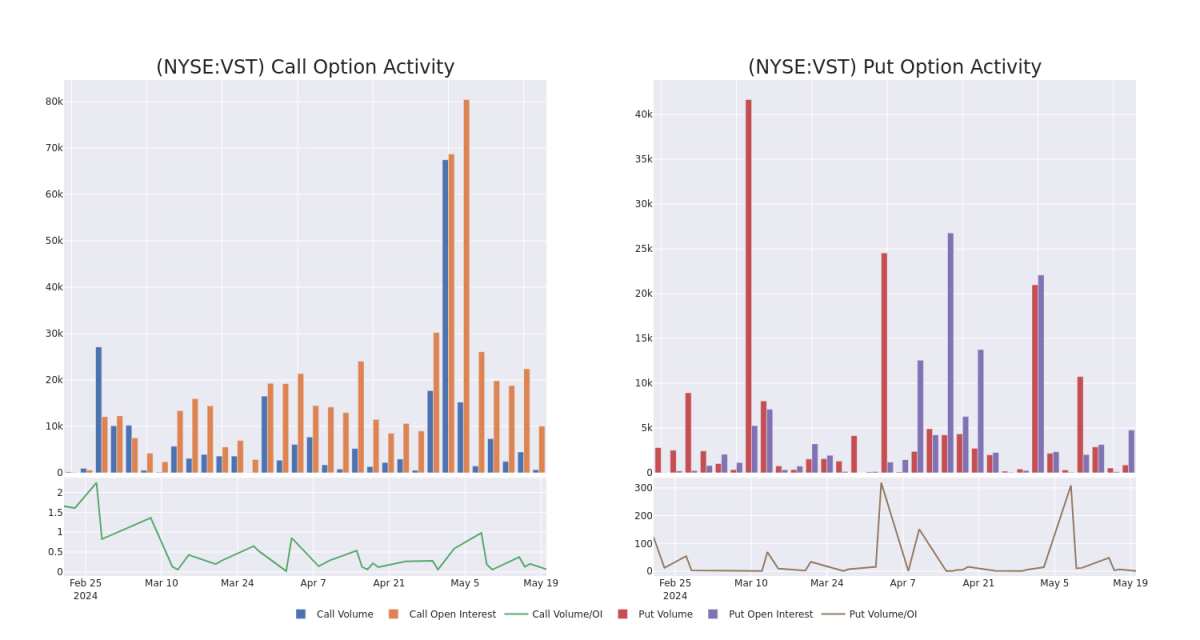

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Vistra's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Vistra's substantial trades, within a strike price spectrum from $40.0 to $115.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Vistra's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Vistra's substantial trades, within a strike price spectrum from $40.0 to $115.0 over the preceding 30 days.

Vistra Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VST | CALL | TRADE | NEUTRAL | 10/18/24 | $54.4 | $51.0 | $52.38 | $40.00 | $136.1K | 1.9K | 26 |

| VST | CALL | TRADE | BEARISH | 10/18/24 | $54.4 | $52.4 | $52.4 | $40.00 | $115.2K | 1.9K | 56 |

| VST | PUT | SWEEP | NEUTRAL | 06/21/24 | $5.9 | $5.7 | $5.8 | $95.00 | $88.7K | 964 | 163 |

| VST | CALL | SWEEP | BULLISH | 06/21/24 | $5.5 | $5.2 | $5.5 | $95.00 | $55.0K | 5.6K | 102 |

| VST | PUT | SWEEP | BEARISH | 01/17/25 | $4.1 | $3.8 | $4.1 | $70.00 | $43.8K | 1.0K | 155 |

About Vistra

Vistra Energy is one of the largest power producers and retail energy providers in the us Following the 2024 Energy Harbor acquisition, Vistra owns 41 gigawatts of nuclear, coal, natural gas, and solar power generation along with one of the largest utility-scale battery projects in the world. Its retail electricity business serves 5 million customers in 20 states, including almost a third of all Texas electricity consumers. Vistra emerged from the Energy Future Holdings bankruptcy as a stand-alone entity in 2016. It acquired Dynegy in 2018.

Having examined the options trading patterns of Vistra, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Vistra

- Currently trading with a volume of 1,999,246, the VST's price is down by -2.48%, now at $91.75.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 79 days.

What Analysts Are Saying About Vistra

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $109.5.

- Consistent in their evaluation, an analyst from BMO Capital keeps a Outperform rating on Vistra with a target price of $109.

- Maintaining their stance, an analyst from UBS continues to hold a Buy rating for Vistra, targeting a price of $110.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.