After Leaping 30% Vanjee Technology Co., Ltd. (SZSE:300552) Shares Are Not Flying Under The Radar

After Leaping 30% Vanjee Technology Co., Ltd. (SZSE:300552) Shares Are Not Flying Under The Radar

Vanjee Technology Co., Ltd. (SZSE:300552) shares have continued their recent momentum with a 30% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 47% in the last year.

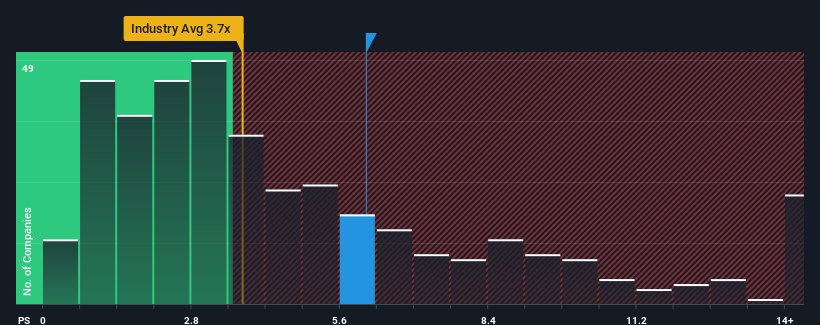

Following the firm bounce in price, when almost half of the companies in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.7x, you may consider Vanjee Technology as a stock not worth researching with its 6.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Has Vanjee Technology Performed Recently?

Vanjee Technology certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Vanjee Technology's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Vanjee Technology would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 43% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 45% as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 26% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Vanjee Technology's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Vanjee Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Vanjee Technology maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electronic industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Vanjee Technology that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.