Even With A 62% Surge, Cautious Investors Are Not Rewarding Keshun Waterproof Technolgies Co.,Ltd.'s (SZSE:300737) Performance Completely

Even With A 62% Surge, Cautious Investors Are Not Rewarding Keshun Waterproof Technolgies Co.,Ltd.'s (SZSE:300737) Performance Completely

Keshun Waterproof Technolgies Co.,Ltd. (SZSE:300737) shareholders would be excited to see that the share price has had a great month, posting a 62% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 34% over that time.

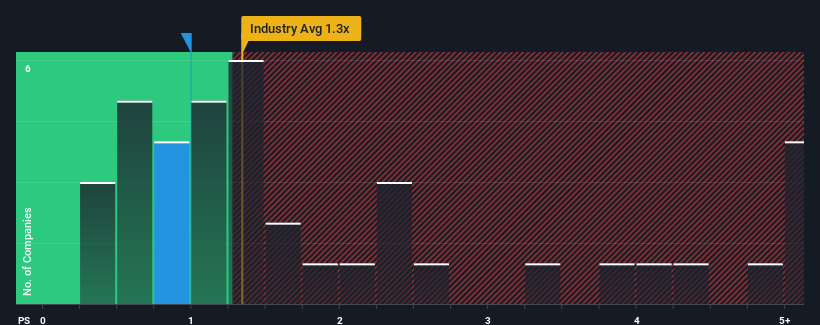

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Keshun Waterproof TechnolgiesLtd's P/S ratio of 1x, since the median price-to-sales (or "P/S") ratio for the Basic Materials industry in China is also close to 1.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Keshun Waterproof TechnolgiesLtd Has Been Performing

With only a limited decrease in revenue compared to most other companies of late, Keshun Waterproof TechnolgiesLtd has been doing relatively well. It might be that many expect the comparatively superior revenue performance to vanish, which has kept the P/S from rising. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues outplaying the industry.

Keen to find out how analysts think Keshun Waterproof TechnolgiesLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Keshun Waterproof TechnolgiesLtd would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.9%. Regardless, revenue has managed to lift by a handy 9.8% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 17% during the coming year according to the eight analysts following the company. That's shaping up to be materially higher than the 12% growth forecast for the broader industry.

In light of this, it's curious that Keshun Waterproof TechnolgiesLtd's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Keshun Waterproof TechnolgiesLtd's P/S

Its shares have lifted substantially and now Keshun Waterproof TechnolgiesLtd's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Keshun Waterproof TechnolgiesLtd currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You always need to take note of risks, for example - Keshun Waterproof TechnolgiesLtd has 1 warning sign we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.