The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. It must have been painful to be a Royale Home Holdings Limited (HKG:1198) shareholder over the last year, since the stock price plummeted 73% in that time. That'd be a striking reminder about the importance of diversification. To make matters worse, the returns over three years have also been really disappointing (the share price is 67% lower than three years ago). Furthermore, it's down 43% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Since Royale Home Holdings has shed HK$468m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

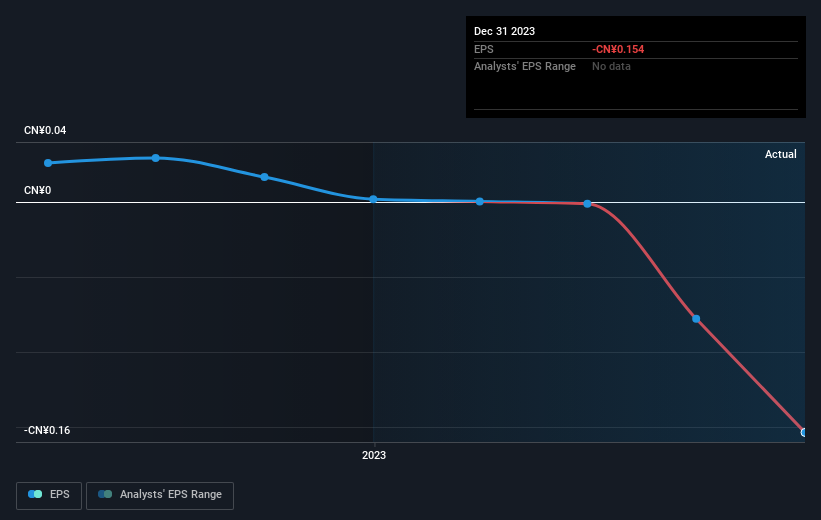

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Royale Home Holdings saw its earnings per share drop below zero. Some investors no doubt dumped the stock as a result. Of course, if the company can turn the situation around, investors will likely profit.

During the last year Royale Home Holdings saw its earnings per share drop below zero. Some investors no doubt dumped the stock as a result. Of course, if the company can turn the situation around, investors will likely profit.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Royale Home Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Royale Home Holdings had a tough year, with a total loss of 72%, against a market gain of about 6.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Royale Home Holdings better, we need to consider many other factors. For instance, we've identified 2 warning signs for Royale Home Holdings that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.