Pak Fah Yeow International Limited (HKG:239) shares have continued their recent momentum with a 31% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 87% in the last year.

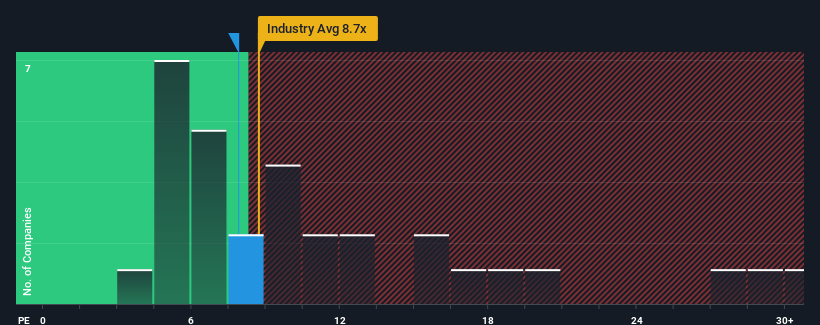

Even after such a large jump in price, there still wouldn't be many who think Pak Fah Yeow International's price-to-earnings (or "P/E") ratio of 7.9x is worth a mention when the median P/E in Hong Kong is similar at about 10x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been quite advantageous for Pak Fah Yeow International as its earnings have been rising very briskly. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Pak Fah Yeow International's is when the company's growth is tracking the market closely.

The only time you'd be comfortable seeing a P/E like Pak Fah Yeow International's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 251% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 21% shows it's noticeably less attractive on an annualised basis.

In light of this, it's curious that Pak Fah Yeow International's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Final Word

Pak Fah Yeow International's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Pak Fah Yeow International revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Pak Fah Yeow International has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.