Zhejiang Zhaolong Interconnect Technology Co.,Ltd. (SZSE:300913) shares have continued their recent momentum with a 33% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 93%.

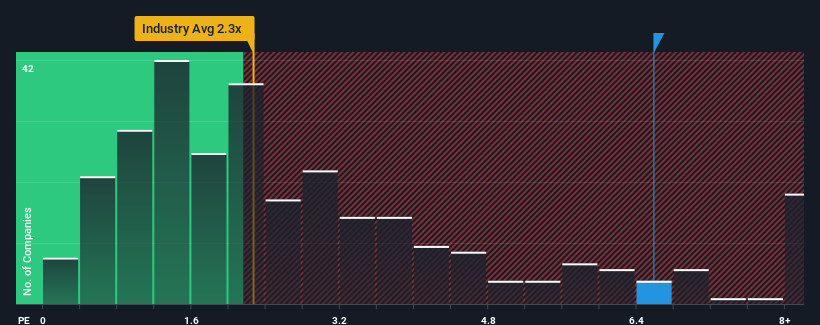

After such a large jump in price, you could be forgiven for thinking Zhejiang Zhaolong Interconnect TechnologyLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6.6x, considering almost half the companies in China's Electrical industry have P/S ratios below 2.3x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Zhejiang Zhaolong Interconnect TechnologyLtd's P/S Mean For Shareholders?

Zhejiang Zhaolong Interconnect TechnologyLtd could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Zhejiang Zhaolong Interconnect TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Zhejiang Zhaolong Interconnect TechnologyLtd's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 25% overall rise in revenue. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 18% over the next year. Meanwhile, the rest of the industry is forecast to expand by 24%, which is noticeably more attractive.

With this information, we find it concerning that Zhejiang Zhaolong Interconnect TechnologyLtd is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

The strong share price surge has lead to Zhejiang Zhaolong Interconnect TechnologyLtd's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It comes as a surprise to see Zhejiang Zhaolong Interconnect TechnologyLtd trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Zhejiang Zhaolong Interconnect TechnologyLtd that you should be aware of.

If you're unsure about the strength of Zhejiang Zhaolong Interconnect TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.